EAST LANSING, MI, February 24, 2021

Euro Pacific Bank, one of the world’s first full-reserve banks, has entered into an agreement with Quavo Inc. to automate its Know Your Customer (KYC) process.

“Account holders at financial institutions often do not understand the extensive review and risk ratings required for new accounts to be onboarded. These processes are highly regulated by governmental agencies and must be compliant with AML regulations” comments Richard Jefferson, Co-founder and Managing Partner of Quavo.

Maria Goncalves, Chief Compliance officer of Euro Pacific Bank continues “Euro Pac has an excellent and detailed set of processes which we are automating with the world’s leading business process management (BPM) platform from Pega and our proven implementation partner Quavo”.

Quavo leverages its KYC accelerator to both ensure industry best practices and minimize implementation time frames. KYC certifies that all customers and related parties are fully risk rated and investigated before doing business, and that periodic reviews are enforced thereafter.

Chartis has given Pega a category leader status in their KYC/CLM Risk Tech quadrants. Their customers include many of the top 100 global financial institutions like American Express, Rabobank, TD Ameritrade and others.

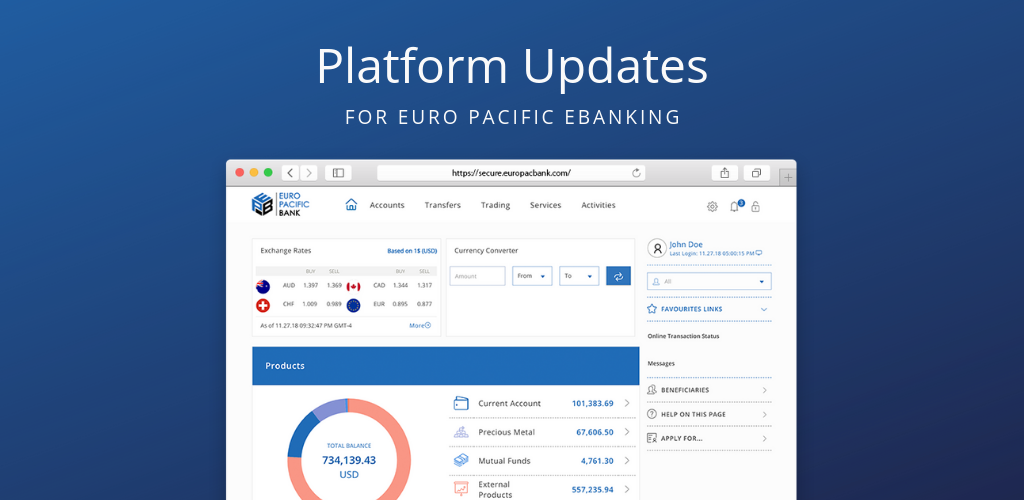

Quavo has just completed an implementation a full customer service solution at Euro Pacific Bank, providing a 360 degree perspective of their customers and managing key processes to ensure timeliness, quality and compliance.

About Euro Pacific Bank

Euro Pacific Bank and its subsidiaries are established in the international banking, brokerage, mutual fund and financial services industry, with roots dating back over 15 years. The Bank seeks to differentiate itself to its global clientele by offering superior services and a diverse range of financial products, all through a stable banking model.

The Bank has a strong focus on compliance and utilizes modern technology and infrastructure, as well as key partnerships, to provide a world class banking experience.

About Quavo, Inc.

Quavo, Inc. is a fintech provider of industry-leading, automated dispute management solutions to issuing financial institutions. Quavo’s Disputes-as-a-Service offering features automated software, AI technology, and human intelligence services for financial organizations of all sizes. Their goal is to establish and advance the industry standard in fraud and dispute management by instituting best-in-class principles, delivering unparalleled technology, and advocating for change in their community.

We offer full, end-to-end automation software for managing fraud and disputes, supported with complete Reg E, Reg Z, Nacha compliance, and network mandates. Quavo’s offering includes QFD™ automated dispute management software, ARIA™ dispute management AI, and Dispute Resolution Experts™ human intelligence services.

Quavo believes in providing a supportive and collaborative environment where the best financial and tech minds work together to drive client success, providing groundbreaking dispute management software and solutions. Learn more online at Quavo.com or by emailing us at [email protected].