brokerage

Table of Contents

Portfolio Overview

P/L and Cash Movements Tools

New Portfolio Overview

New Navigation

Historic Reports

Deposit and Transfer

Other Account Functions

Portfolio Overview

The new Performance Overview offers a dashboard showing your Account Performance, percentage returns and changes in cash value of the account (or all accounts) for the selected period

Account Summary

The Account Summary includes the:

- Account Value at the start and end of the selected period and the Change in Account Value

- P/L related to trading activities (trade P/L, costs, financing, corporate actions etc.)

- Non-trading related bookings such as cash and security Transferred (interest, exchange subscriptions, exchange rate movements, etc.)

Account Value chart

The development of your account value over the selected period including cash and security transfers and everything booked on the account.

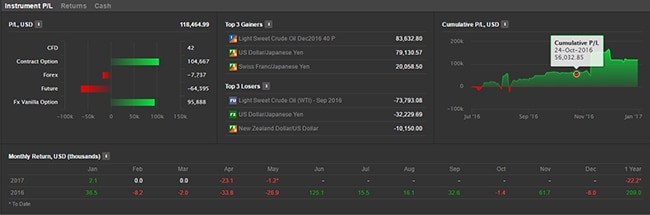

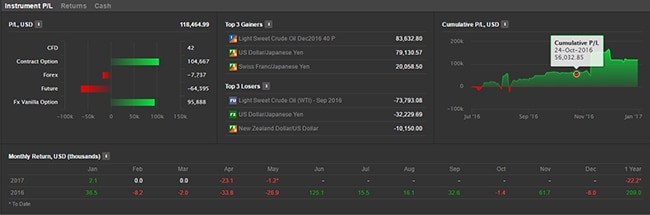

Instrument P/L

The Instrument P/L tab gives access to P/L breakdown for the selected account(s) and period.

P/L figures In the Instrument P/L section include:

-

Realized gains and losses (positions closed in the period)

-

Unrealized gains and losses (positions still open at the end of the period

-

All trading costs associated with a position such as holding costs, financing charges, rollovers, corporate actions, coupons, etc.

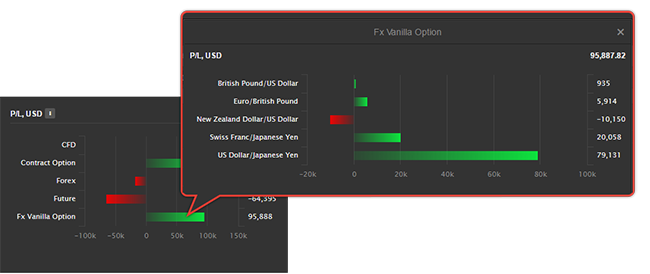

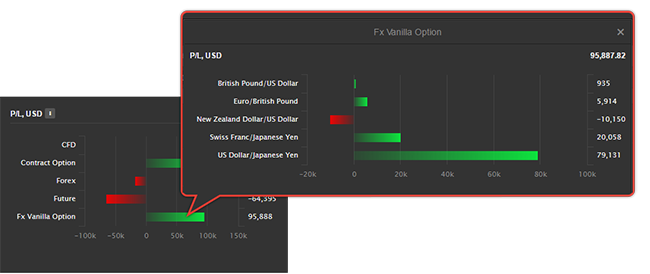

P/L Bar Chart

The P/L bar chart shows the net P/Ls for each product traded in the period.

Click on a bar to show the P/L breakdown for individual instruments traded in the period.

Top 3 Gainers and Losers

Top 3 Gainers and Losers show the 3 instruments with the greatest gain and loss in the selected period.

Cumulative P/L chart

The Cumulative P/L chart shows the development of the P/L on the account(s).

Monthly Return table

The monthly returns table shows the P/L by month since the account was opened.

Returns

Returns gives access to % returns for the selected account(s) and period:

%Return Chart

The % Return chart shows the development as the time-weighted percentage performance over the period excluding cash and security transfers.

Winning % Indicators

- The percentage of days in the period where your account had a profit/loss.

- The percentage of closed trades in the period with a profit/loss.

Statistics

Account statistics for the selected period.

Monthly % returns table

The monthly returns table shows the % returns by month since the account was opened.

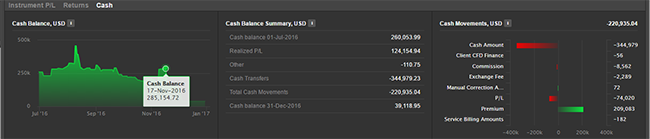

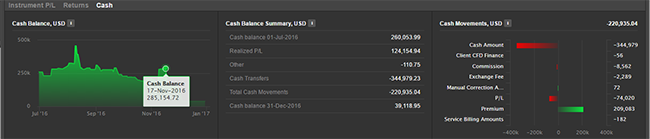

Cash

The cash panel shows the development of the cash balance for the selected account(s) and period.

Cash Balance Chart

The % Return chart shows the development in the end-of-day cash balance over the period including cash and security transfers.

Cash Balance Summary

The Cash Balance Summary includes the:

- Cash Balance at the start and end of the selected period and the Total Cash Movements in the period

- Realized P/L from positions closed in the period (trade P/L, costs, financing, corporate actions etc.)

- Cash Transfers and Other bookings from non-trading related bookings such as cash and security Transferred (interest, exchange subscriptions, exchange rate movements, etc.)

Cash Movements Bar Chart

The Cash Movements bar chart shows the net cash movement for each product traded, cash transfers and other booking types in the period.

P/L and Cash Movements Tools

P/L Analysis tools allows you to analyze P/L, associated costs and bookings down to the instrument level in detail. Analyze P/L by trading product, specific instruments or sectors, charting the cumulative P/L graphically or itemizing all transactions associated with product or instrument.

Profit/Loss

Profit/Loss allows you to analyze and show the cumulative Profit and Loss through trading an instrument, product or sector in a selected period.

For a selected period and account (or all accounts) you can analyze P/L by:

- Asset Type to analyze P/L by product (FX, CFD, Stocks, Futures etc.) and drill down to the instruments traded within a product

- Instrument to see the cumulative P/L development from trading a specific instrument

- Sector (where sector information is available) showing P/L by instruments traded within each sector

- Custom grouping P/L by any combination of Asset Type (product), month, year, sector, and instrument), for example, to show P/L by instrument, grouped by month traded (closed)

Cash Movements

Cash Movements allows you to analyze all bookings on your account (cash movements) associated with trading in a product or a particular instrument.

For a selected period and account (or all accounts) you can analyze bookings by:

- Asset Type to analyze bookings by product (FX, CFD, Stocks, Futures etc.) to drill-down to bookings for each the instruments traded within a product

- Instrument to see bookings for a trades in a specific instrument

- Sector (where sector information is available), showing bookings by industry. This also allow you to drill-down to the instruments traded within each sector

- Custom groupings showing bookings by any combination of Asset Type (product), month, year, sector, and instrument to show for example, bookings grouped by month traded (closed) for example

Closed Positions

For a selected period, Closed Positions shows positions that have been closed and booked on your account (or all accounts).

You can filter the Closed Positions by asset type (product) to limit the results shown.

New Portfolio Overview

The Portfolio Overview gives an overview of current net holdings on an account(s) and gives access to a historic view of the portfolio.

Allocation

The Portfolio Overview shows the following:

- exposure to each instrument and product (in the currency of the instrument)

- % allocation of the instrument of the holdings in that asset class (product)

- % allocation of the instrument of the total portfolio

Current Account Values

The Portfolio Overview also gives shows the current cash available, value of positions and account value, and shows the % days change on the account.

Historic View

You can see how your portfolio looked historically at the end of any day using the date selector showing the account values, holdings and allocations at the end of selected.

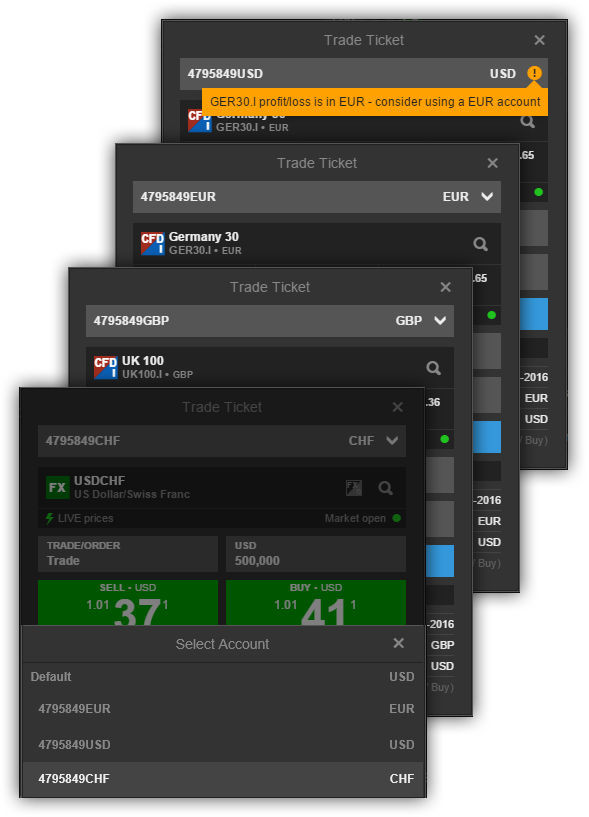

New Navigation

The new Account Section introduces horizontal navigation aligned with the rest of the GTS platform. The simplified navigation reduces the number of Account Sections and maximizes the available space for reports.

Historic Reports

Historic Reports have been reorganized into tiles giving a better overview and description of the report.

Deposit and Transfer

Transferring funds and withdrawing funds to and from your account, security transfers have also been organized into convenient tiles in the Deposit and Transfers section of the Account Section.

Other Account Functions

Trading Conditions, Subscriptions, Activity log, Contact Support Upcoming Margin and Collateral Changes, Mifid Status, Corporate action events have been moved under the Other menu and re-organized as tiles with a description of the service.