Published: October 11, 2021

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold and Precious Metals

- Peter Schiff

Our Commentary

Market overview

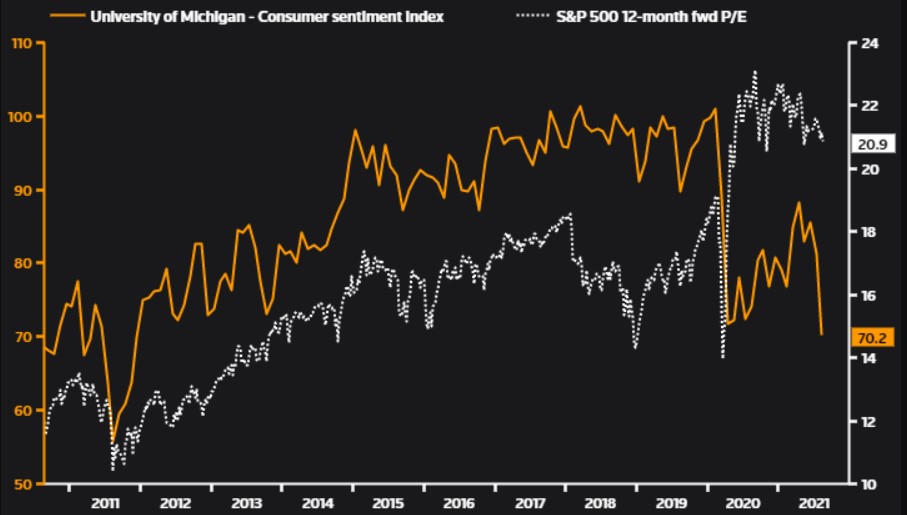

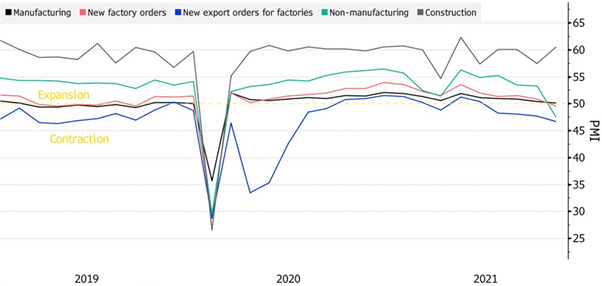

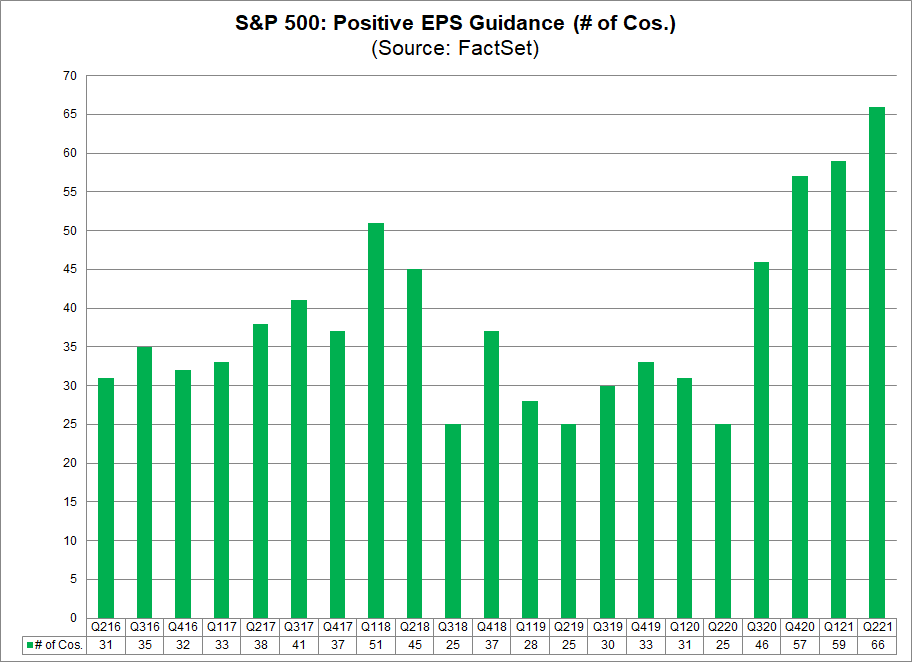

September witnessed the reversal of third quarter’s gains as turbulent equity and bond markets suffered declines due to a broad range of factors:

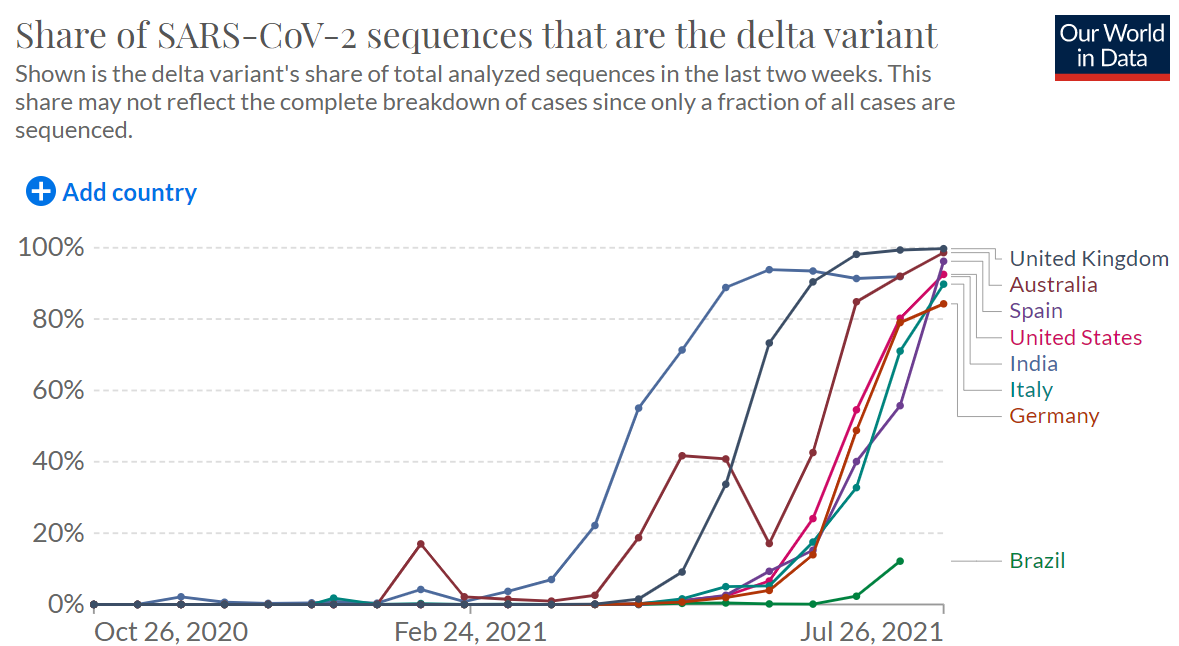

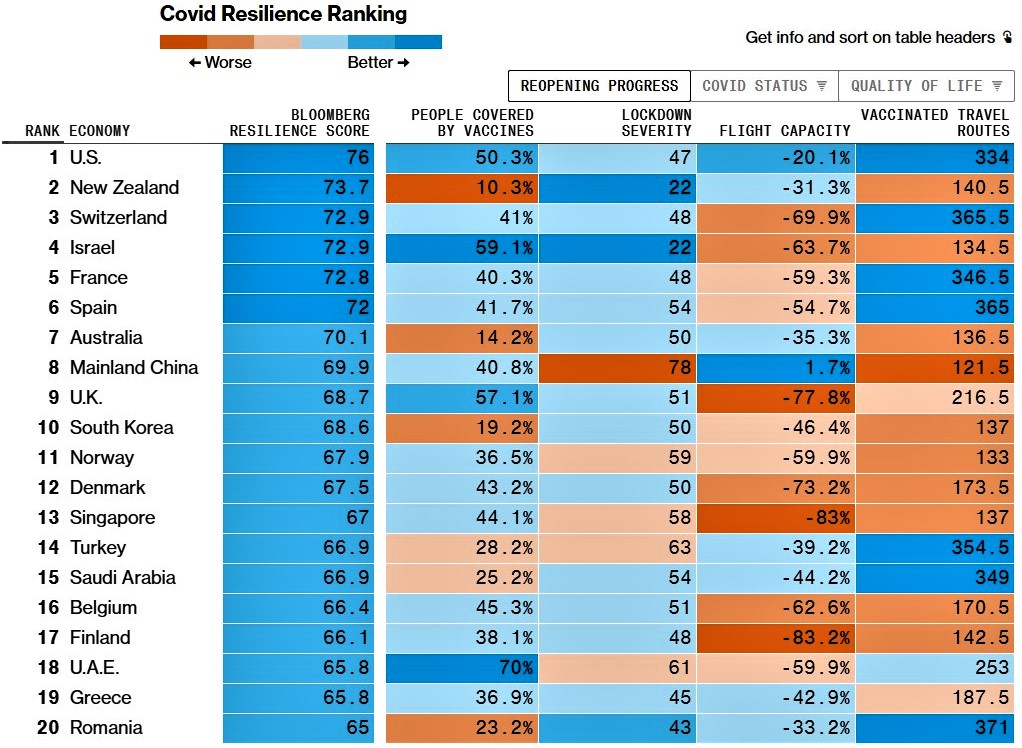

- Concerns about global growth waning due to the highly infectious Delta Covid variant

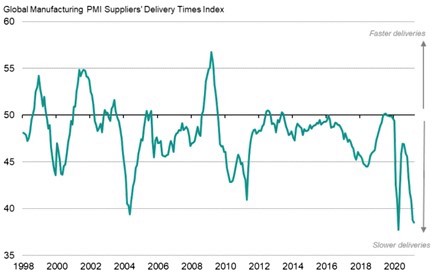

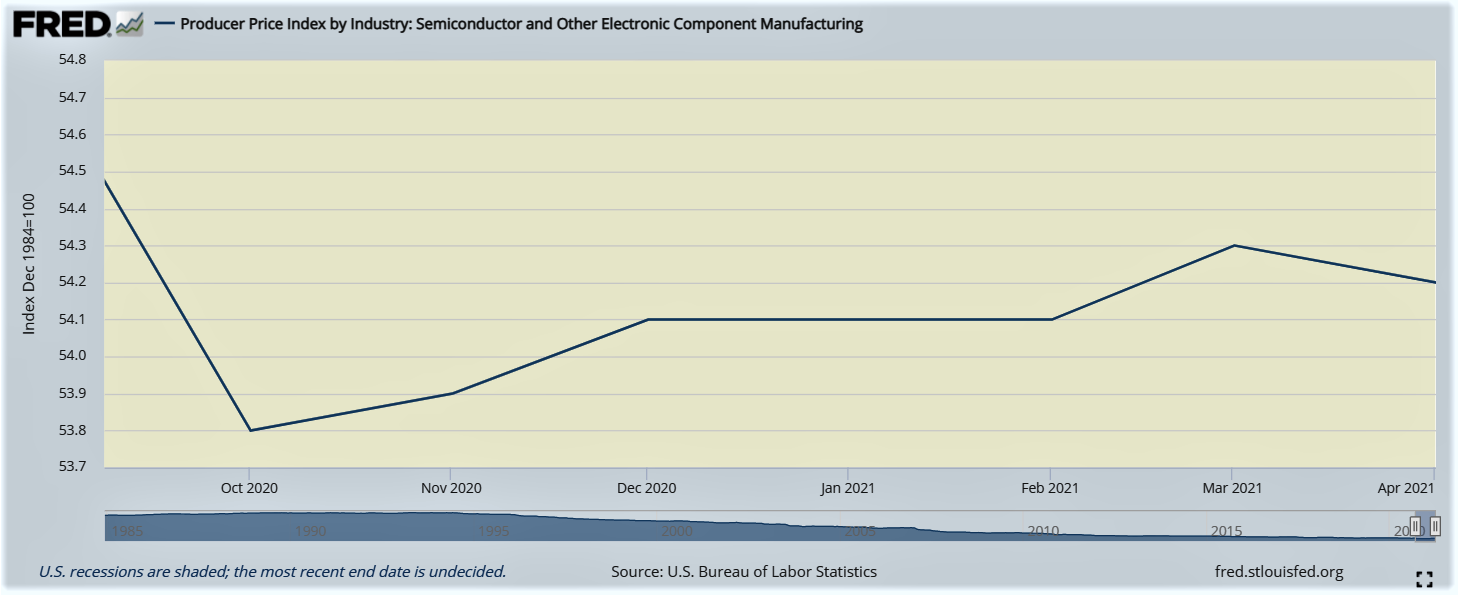

- Broadening and deepening supply bottlenecks

- Rising inflation and hastening interest rate rises

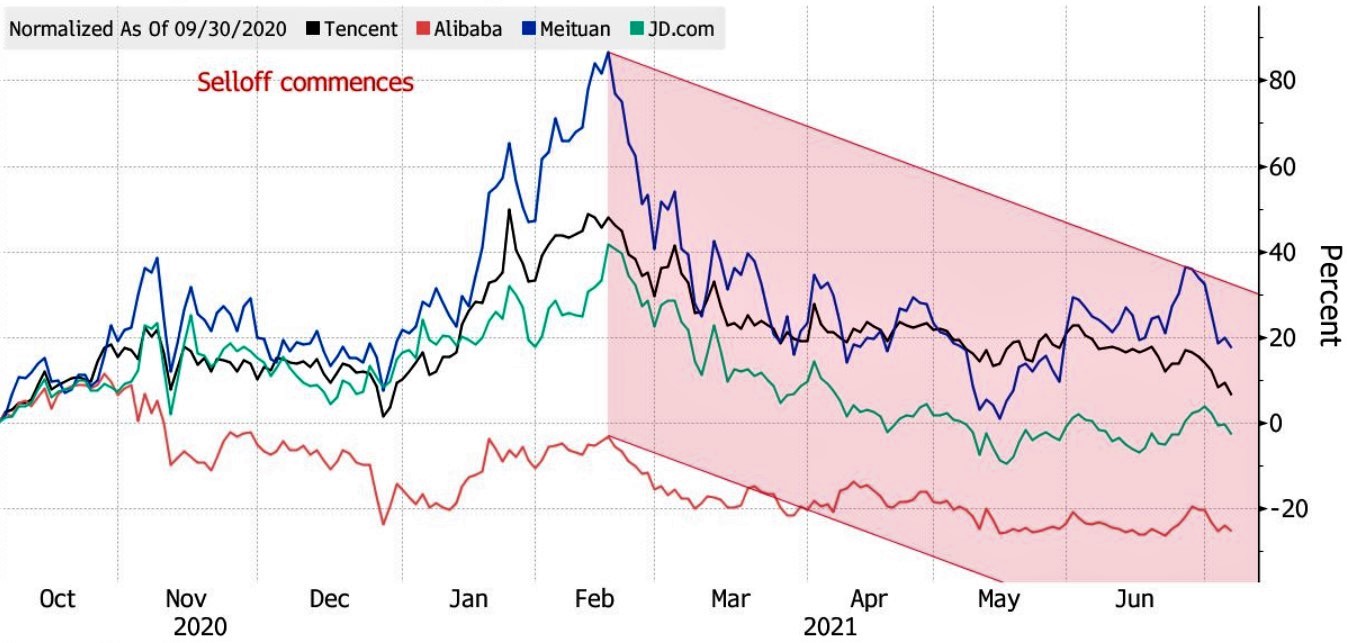

- Numerous negative developments in China seen as posing downside risks to financial markets

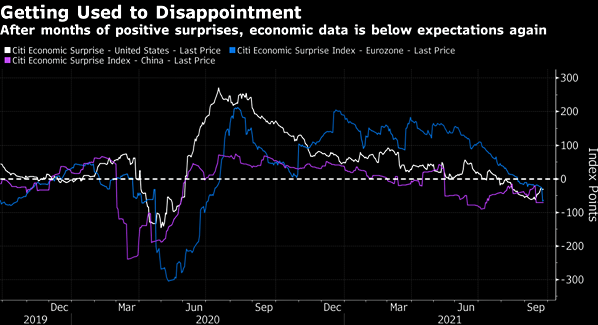

Evidently, the Citi Economic Surprise Index, shown below, highlights the extent to which negative economic surprises are now exceeding positive surprises.

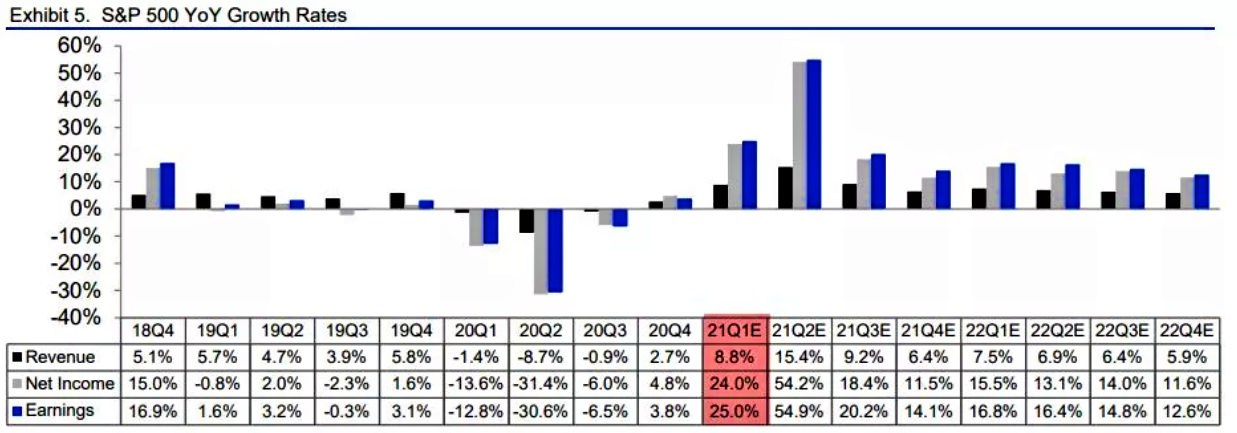

For the month, the S&P 500 Index declined by 4.9% and the NASDAQ by 5.3%, while the FTSE all-share Index retreated by 1.1% and the Eurostoxx 50 by 4.7%.

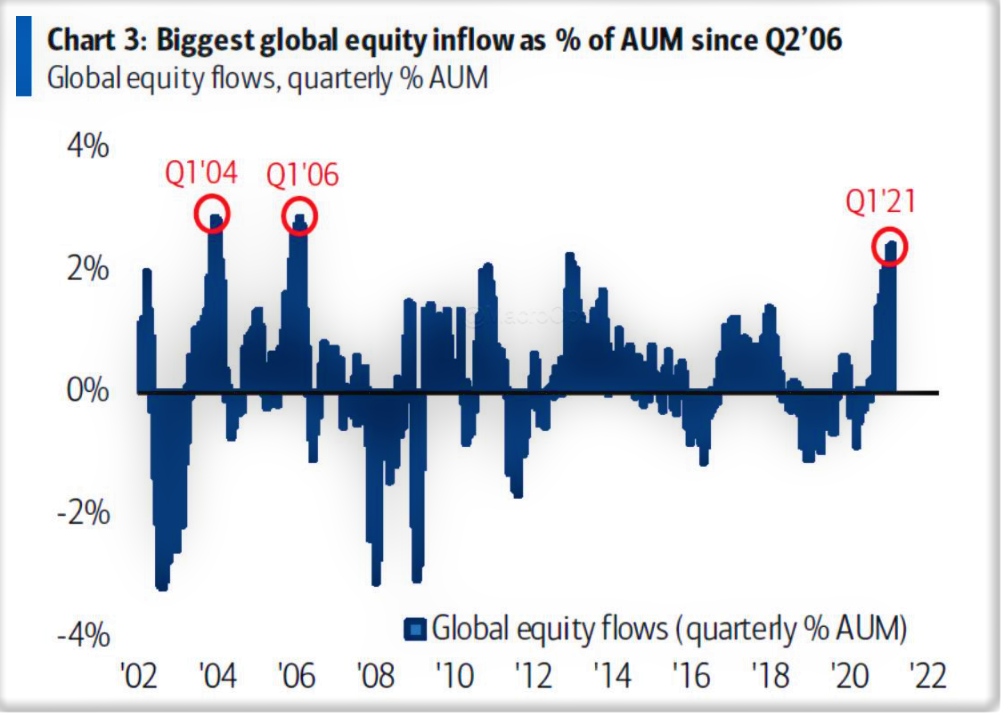

In the U.S., sector rotations continue to play a large part in investor strategy. According to our observation, nearly 90% of S&P 500 constituents have experienced at least a 10% correction during the year but the index has not drawn down by more than 5% at any point.

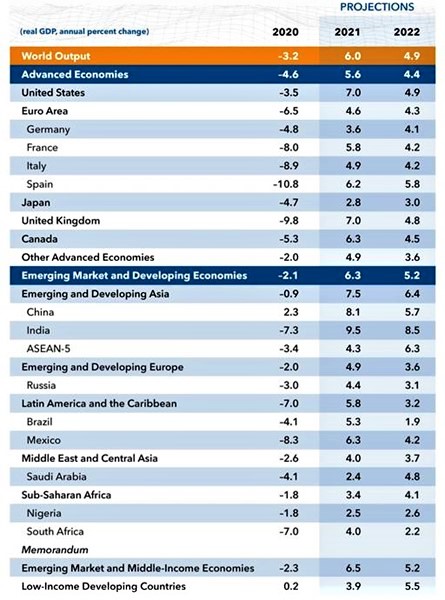

Contrastively, pockets of emerging markets performed better, such as the MSCI India index which registered a 2.0% gain. Nevertheless, all major stock markets remain in positive territory year-to-date except for China’s CSI 300 Index, which has declined almost 7%.

Elevating pressures from Central Banks

This year, investors have been focused on the impact of the looming debt ceiling deadline and the US Federal Reserve’s tapering intentions. For a brief period, the prospect of a government shutdown and the worst-case scenario of a sovereign debt default and downgrade suggested that the Fed may have to move out its tapering timeline. However, the U.S. Senate eventually announced a deal which avoided shutting down on October 1st and extended government spending until December 3rd of 2021.

Meanwhile, tapering looks set to begin based on the Federal Open Market Committee’s (FOMC) post-meeting comments in late September. The committee judges that a moderation in the pace of asset purchases may soon be warranted and Chairman Jerome Powell opined that “a gradual tapering process that concludes around the middle of next year is likely to be appropriate.”

Another major concerns by investors is rising interest rate. The majority of FOMC members see the first US interest rate hike happening in 2022, a shift from June’s meeting when the majority expected it in 2023. As a result, the 10-year US Treasury yield has bounced off its lows and is trading at about 1.5% — a level investors were expecting only later this year.

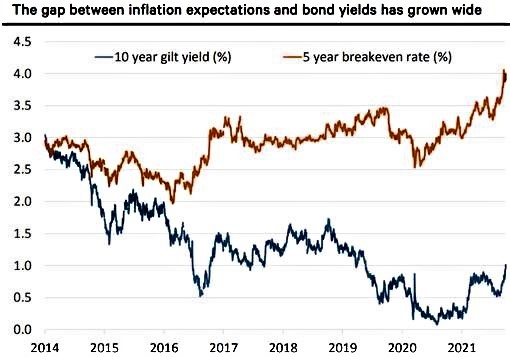

Across the Atlantic, the minutes from the Bank of England’s September Monetary Policy Committee meeting also highlight increasing concern about the durability of inflation. Some commentators now expect two interest rate rises next year with the first coming as early as the spring.

UK gilts have reacted to the changes in interest rate expectations even more strongly than US treasuries with a 50 basis points increase in 10-year yield since mid-August. This trend may has further to run as inflation continues to surpass the Bank of England’s expectations. It now forecasts consumer price inflation to peak above 4% at the turn of the year (well-ahead of the 2.1% forecast it issued in February) and not to fall back to its 2% target until the second half of 2023.

China sentiment further deteriorates

Evergrande crisis

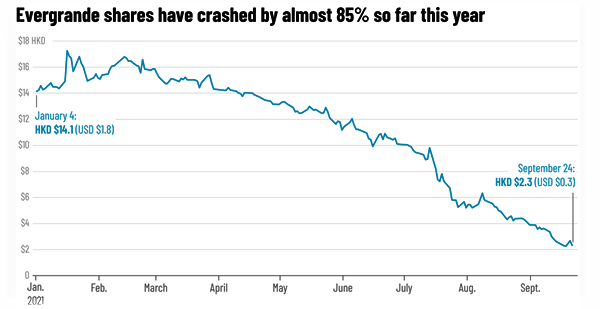

In addition to slowing Chinese economic growth and government crackdown on the tech sector and online education industry as discussed on a past commentary, the news that Chinese property giant Evergrande was facing a debt crisis derailed market sentiment further. The property developer amassed mountains of debt, predominantly domestically, when it expanded from housing into a range of other ambitious initiatives including electric vehicles, sports, and theme parks.

The crisis came to a head in late September when Evergrande failed to meet a debt payment. It has 30 days to settle and avoid triggering a formal debt default. Investors are on edge, waiting to see whether the government will back the debt, whether it will be rescheduled or whether the company will default and become akin to a “Chinese Lehman Brothers.” In dealing with this issue, the Chinese government is not expected to bail out the company, but it has been adding liquidity to financial markets to avert broader contagion.

Implications

Evergrande’s situation has broader ramifications for China and, to an extent, global economy because the Chinese property sector contributes almost a third to Chinese GDP. As a result, a slowdown in the Chinese economy would not bode well for the rest of the world, which has relied on the vibrant recovery in China to provide tailwinds for their own economies.

We can perhaps gain some comfort from the commitment of the Chinese government to reducing speculative activities in the economy and implementing regulations to prevent excesses from building up. The intention is to introduce more balance into the Chinese economy and promote “common prosperity”. The success will depend on whether the regulators can steer the private and public sector without too many missteps.

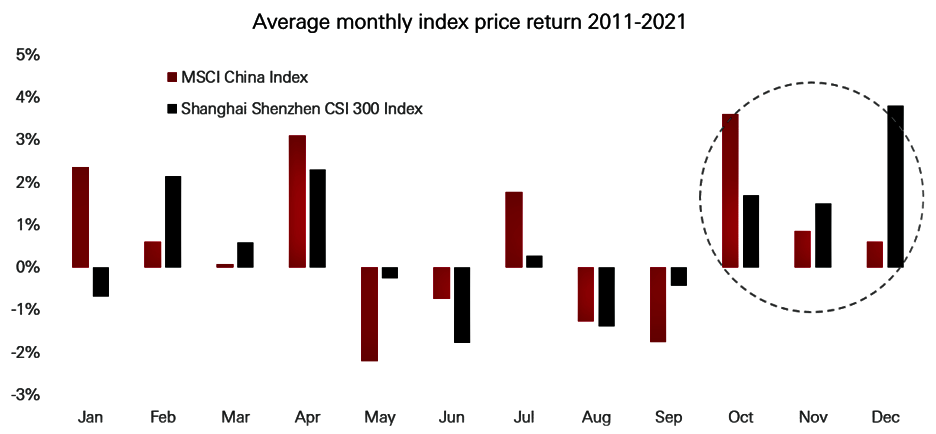

Despite sentiment in Chinese markets is currently weak and government policy is putting the brakes on growth, the year’s final quarter is historically strong for Chinese equities with prices moving up on average by 3.6% in October alone.

Portfolio Actions

Our Chinese equity exposure is balanced between infrastructure and technology sectors which, notwithstanding recent interventions, offer huge growth prospects at relatively low valuations. Furthermore, we have no direct exposure to Evergrande so concerns over the company’s default risk is very low on our table. From both a short and longer term perspective, we think it is not the time to withdraw from investing in the world’s second largest economy.

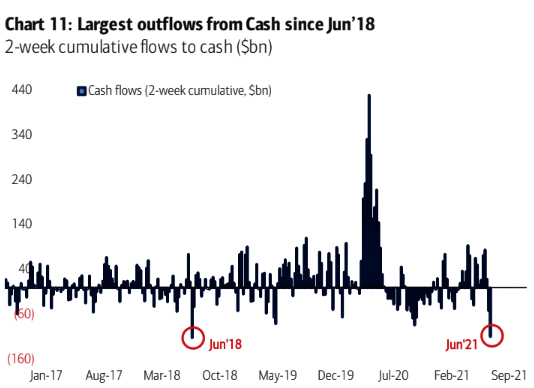

On the other hand, with interest rate hikes and the FED’s tapering coming possibly later this year or next year, our International Balanced and International Growth fund are well-diversified to withstand any potential short-term market volatility. Tactically, we are also holding less than 10% of our funds’ weight in cash to take advantage of any potential market’s pullback.

The portfolios’ September performance is as followed:

| Fund Name | Performance |

|---|---|

| International Balanced | -2.62% |

| International Growth | -2.54% |

| Natural Resources | +0.96% |

| Gold & Precious Metals | -11.47% |

Regards,

Euro Pacific Advisors Management Team