Published: July 06, 2021

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold and Precious Metals

- Peter Schiff

Our Commentary

Vaccination progress

Around three billion doses of COVID-19 vaccines have now been administered in what has become a race against ever-emerging variants of the virus.

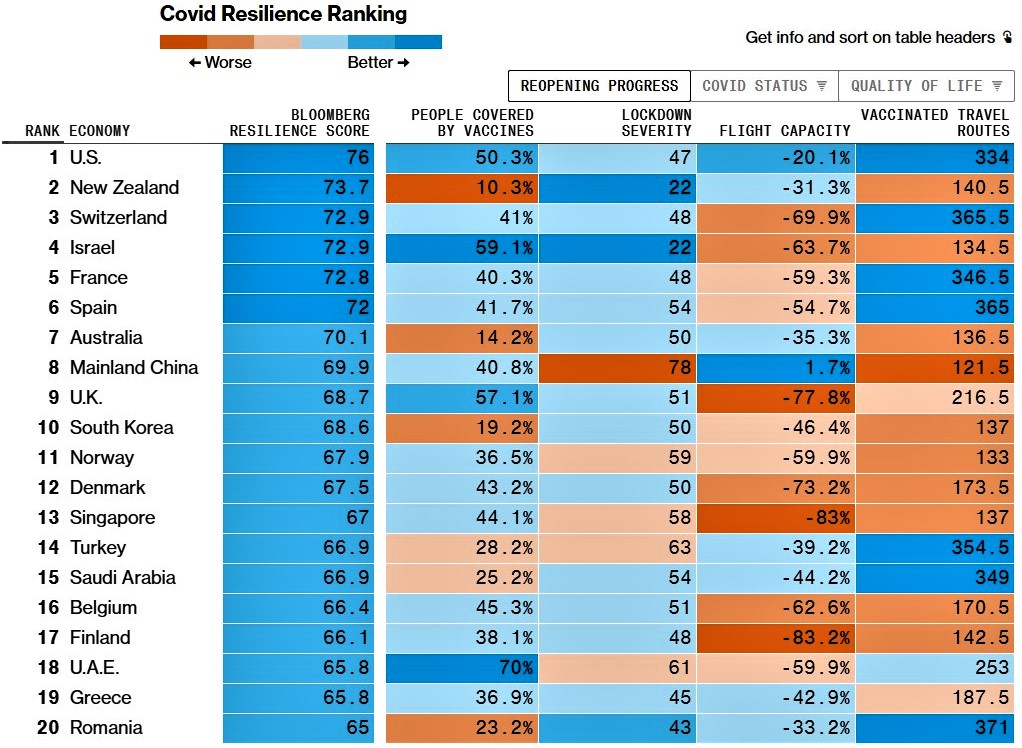

The success of the vaccination campaign in the United States has resulted in it now taking top spot in the Bloomberg Covid Resilience Ranking with many travel routes opening up to those vaccinated.

However, the Delta variant has become a particular cause of concerns in the UK, Europe and South Africa. The highly contagious variant is responsible for upwards of 90% of new infections in the UK.

Europe is divided on opening travel to other regions, with southern nations eager to participate in the usual summer tourism trade and northern countries, particularly Germany, loathe to risk another upsurge in infections.

Overall, the progress in vaccination campaigns combine with strict border control policy by governments have made a positive impact in controlling the infection rate. However, it is reasonable to remain cautious about the danger of new COVID variant emergence, which can surprise and cause panics in the markets.

How is the global economy recovering?

The path to full economic recovery continues apace. Vaccine progress has fed through to the uneven growth prospects of developed versus emerging economies, with Africa a particular laggard in this respect. While global growth prospects have been repeatedly upgraded this year by the likes of the IMF, World Bank and the OECD, the overall 4% plus growth this year belies an increasing divergence in growth across the globe.

The strength of the global recovery is largely attributable to a handful of major economies. The US and China, for instance, are each expected to contribute more than 25% of global growth this year and the US’s contribution is outsized relative to recent history – almost three times its 2015 to 2019 average.

Estimates for growth in Europe are also increasing. SP Global has upgraded its forecast for the Eurozone to 4.4% this year and 4.5% in 2022, noting the recovery now extends from industrial production to services as most restrictions are lifted and households start spending again.

Despite the anticipation of a strong recovery, the World Bank still expects 2022 global output to remain about 2% below pre-pandemic projections.

Corporate earnings remain resilient

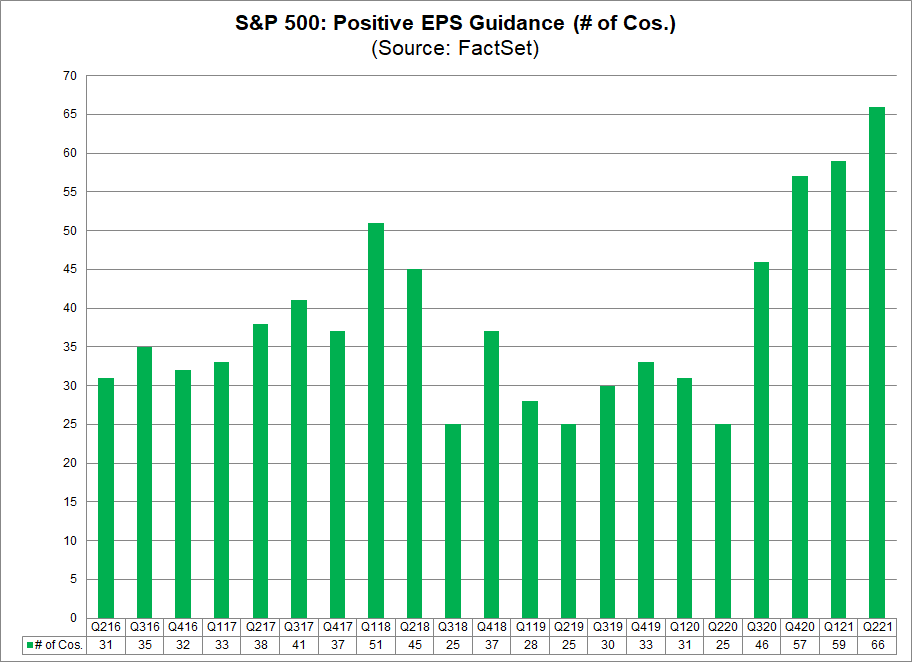

Corporate earnings continue to beat expectations, contributing to upbeat forecasts for the year as a whole. Although base effects are magnifying the numbers, with the second quarter increase likely to be most pronounced, earnings growth would still be positive versus 2019 even without the base effect.

Based on the extent of the upside earnings surprises in the first quarter, for the year as a whole, earnings are expected to increase 35% after declining 13.1% last year – a considerable recovery.

Thus, while concerns have grown about whether an equity market meltdown may be in the offing, given the sky-high valuations, stocks could continue to rise if these earnings expectations are met.

Anyhow, our International Growth & Balanced Funds remain diversified to anticipate any unexpected market moves in the short and long-term.

Reflation trade paused, commodities saw mixed results

June saw a dialing back of the reflation trade, as concerns about inflation eased off towards month end and the technology sector once again outperformed.

This shift is evident in the Nasdaq’s 6.4% gain versus the Dow Jones Industrial Average, while the FTSE, and Japan’s Nikkei ended the month broadly unchanged.

India’s stock market put in its best performance of the year to date. There are some concerns about extended equity valuations, but the improvement in the country’s economic outlook during June as lockdown measures were removed, vaccinations continued apace and the economy opened for business again, served to sustain investor optimism.

The sectors that have taken the lead are materials and industrials, which are seen as offering the best performance potential during a cyclical economic revival. There are also opportunities in real estate, such as new generation technology parks (India has 75% of the world’s digital talent) and infrastructure.

The steep upward march in commodity prices for the first five months of the year plateaued during June, with the Bloomberg Commodities Index slipping 0.15%.

Oil prices remained strong, with the Brent Crude price gaining 8.2% to end the month above $75 a barrel. Gold lost ground as risk appetite remained in force.

The precious metal ended the month below $1,800, down some 7%, while copper’s record rally also lost ground during the month, with the price coming down 8.8%.

Don’t take your eyes off inflation yet

All eyes remain on any signs of inflationary pressures that could prove more entrenched than the central banks think likely. US inflation figures were higher than expectations and opinion remains divided on whether inflation will become a problem or prove transitory once the dust has settled. Federal Reserve Governor Jerome Powell called for patience, saying it wasn’t the time to make hard predictions in such unprecedented times.

However, a slightly more hawkish tone did appear in the Federal Open Monetary Policy Committee statement, with the dot plot bringing forward interest rate increases. Powell indicated that the bank would be talking about asset purchases in the meetings to come but warned against interpreting the dot plot as a forecast of interest rate moves. He stressed that any decisions around tapering would be well telegraphed and thus would be no surprise to investors.

In the immediate aftermath of his comments, markets sold off and US Treasury yields spiked. Subsequently, stock markets have rallied to end the first half of the year on a positive note.

Portfolio Actions

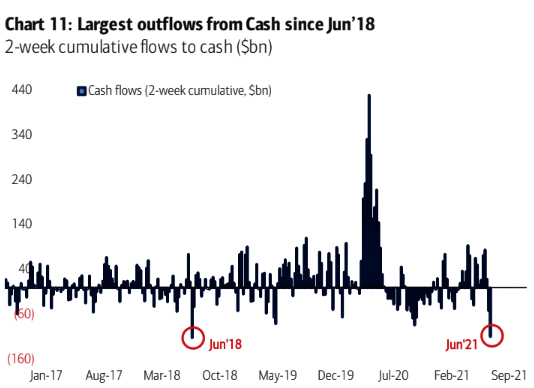

For now, the market has shrugged off any concerns about rising rates. However, volatility will likely return as we get close to the next Fed’s meeting in July, or at least until year’s end.

Our fund managers are therefore tactically allocating less than 10% of our portfolios’ value in cash to take advantage of any short-term opportunities arising in the future.

The portfolios’ June performance is:

| Fund Name | Performance |

|---|---|

| International Balanced | +2.93% |

| International Growth | -0.10% |

| Natural Resources | -3.26% |

| Gold & Precious Metals | -10.68% |

Regards,

Euro Pacific Advisors Management Team