Published: December 07, 2021

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold and Precious Metals

- Peter Schiff

Our Commentary

Market overview

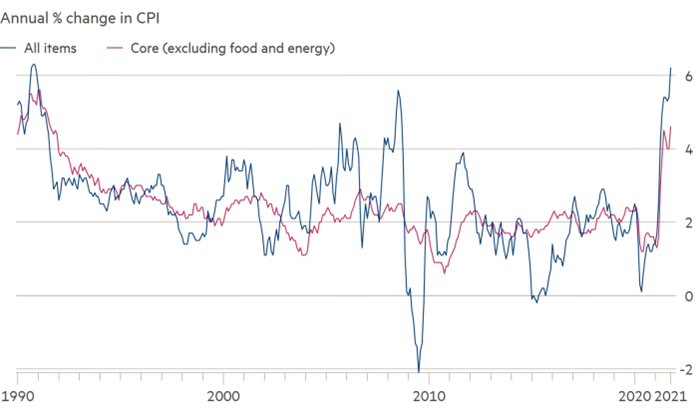

In a month which saw the emergence of a new acronym: VFI (Variants, Federal Reserve and Inflation), stock markets were volatile, achieving new highs early in the month before being knocked back by US inflation coming in at a 31-year high, and then slumping as news of the new Covid-19 Omicron variant emerged. The S&P 500 Index slipped marginally into the red, while the Dow Jones Industrial Average and Nikkei 225 fell 4%. The UK FTSE 100 Index and the Euro Stoxx 50 both declined a little over 2%. All developed equity markets remain in the black for the year to date, though, while most bond markets are weaker.

Equity markets remain underpinned by corporate earnings growth, with Macy’s, Kohl’s and Nvidia the most notable advances after posting market-beating numbers. Overall, growth indicators remain positive.

Meanwhile, energy concerns abated as President Biden indicated that the US may release more reserves, and pressure built on OPEC to add supply to the market. The retracement in prices accelerated as news of the Omicron variant became public and countries began shutting their borders.

Fed timetable for tapering asset purchases

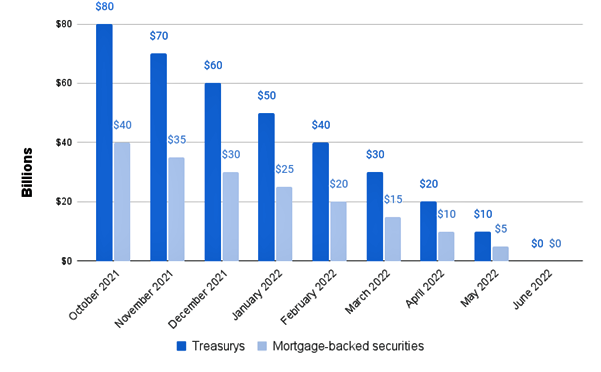

The main policy development came with the Federal Reserve announcing it would begin tapering its asset purchases with a view to completing the process by June next year.

The chart below indicates the pace of tapering as anticipated at the meeting in early November, although subsequent comments indicated this may be accelerated. Equities and bonds responded positively but then became concerned about whether persistently high inflation would prompt the central bank to start raising interest rates more aggressively than their guidance suggested. There is a danger that, with demand still buoyant, supply issues exacerbated by new restrictions to prevent the spread of the new Covid-19 variant will further fuel rises in inflation.

Carbon credit markets in focus after COP26

The UK hosted the 26th UN Climate Change Conference (COP26) in early November and this gave new life to the carbon credit market with a number of agreements made on the rules that govern it.

Background

The carbon credit market has its roots in the 1997 UN Kyoto Protocol, the first time the world’s governments agreed on the need to cut carbon emissions. Called the Clean Development Mechanism, it facilitated the reduction of industry and country emissions through the trading of carbon credits. Today, there are two markets: the voluntary exchange of carbon credits and the involuntary carbon compliance market.

The former allows companies and individuals to buy carbon credits to compensate for their carbon emitting activities. These credits are then invested into carbon-catching activities aimed at reducing the level of emissions by planting forests and other activities. The global standard is that one carbon credit represents one ton of carbon dioxide equivalent (CO2e) removed from the atmosphere.

How it works

The carbon compliance market is otherwise known as the cap-and-trade market. Governments set caps on the amount of CO2e companies in high-emitting sectors (e.g., oil, energy, transportation) are allowed to emit before they are required to buy carbon credits. The intention behind this is to help companies make a gradual transition to a sustainable, carbon-free future, avoiding the disruption and cost (to company and economy) that overnight change would cause. Emitting companies have time to transition their business, while the projects in which the carbon credits are invested balance the equation, capturing carbon and neutralizing the emissions impact of the company buying the credits.

When companies reach their cap, they can buy and sell carbon credits on regulated exchanges. According to the World Bank, there are around 64 carbon compliance markets currently in operation, the largest of which are in the EU, China, Australia and Canada. The US has no overarching federal approach to requiring companies to comply by reducing emissions. Instead, states have been free to take an independent approach, with California the only one with a formal cap-and-trade market.

Strengths and weaknesses

The current cap-and-trade system is vulnerable to fraud, double counting and greenwashing. In the early days of the carbon credit market, white collar criminals took advantage of tax loopholes by fraudulently claiming VAT receipts through complex arrangements of companies in different jurisdictions.

More recently, companies have been found double counting the carbon credit, once in the country in which they operate and again in the country where the credit is bought. There is little oversight of projects that are supposedly reducing emissions. For instance, some tree planting projects have been found to cut down the trees after gaining the credit.

To reduce the likelihood of nefarious schemes, regulators are eager to globalize the carbon credit market. However, there are challenges in agreeing parameters such as time frame, pricing, measurement and degree of transparency.

Opportunities

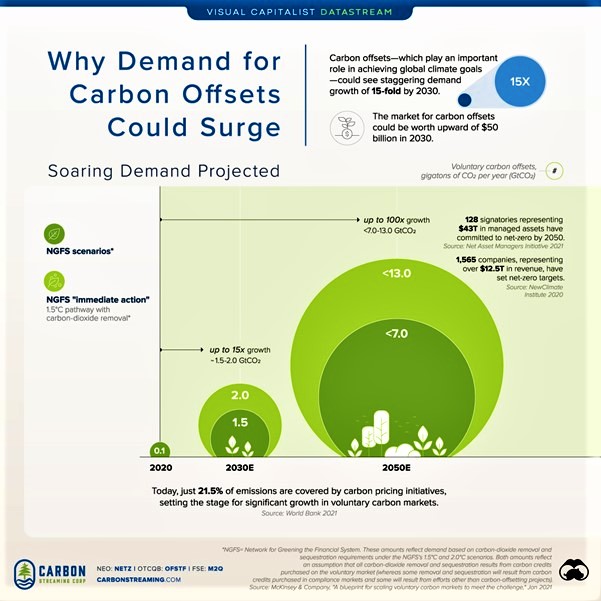

Notwithstanding the challenges, the future for the carbon credit market looks bright. According to a September report by Ecosystem Marketplace, in the first eight months of 2021, voluntary carbon markets had already posted a near-60% increase in value from last year to more than $1 billion. With market volumes and value rising strongly, more speculators are purchasing credits. This then becomes a source of finance for green projects around the world. A tightening of processes and rules at COP26 could open the door to billions of dollars of investment over the next decade.

A recent Visual Capitalist infographic highlights the potential 15-fold growth in carbon offsets by 2030:

Outlook

VFI (Variants, Federal Reserve and Inflation) will continue to have influence over market sentiment and price action in the medium term as they have always been since the beginning of this year.

In the medium term, we think the equity market will remain buoyant with the support of solid corporate earnings growth and the likelihood of a strong shopping season in December despite supply chain shortage remains a concern.

The carbon compliance market, which is projected to grow to 50 billion dollar by 2030, is a lucrative investible opportunity that needs attention from savvy investors. We will explore this topic further in future commentaries.

The portfolios’ November performance is as followed:

| Fund Name | Performance |

|---|---|

| International Balanced | -1.44% |

| International Growth | -1.87% |

| Natural Resources | -4.39% |

| Gold & Precious Metals | -2.22% |

Regards,

Euro Pacific Advisors Management Team