Published: November 09, 2021

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold and Precious Metals

- Peter Schiff

Our Commentary

Market overview

Most equity markets rebounded in October despite a multitude of concerns. Quantitative easing is still going at a pace unimaginable a few years ago and trillions of dollars of new stimulus measures look set to pour fuel onto an inflationary fire running at an annualised 5.4% in the USA. Supply chains are squeezed as never before in peacetime and wages are rising rapidly, probably far faster than the official figures.

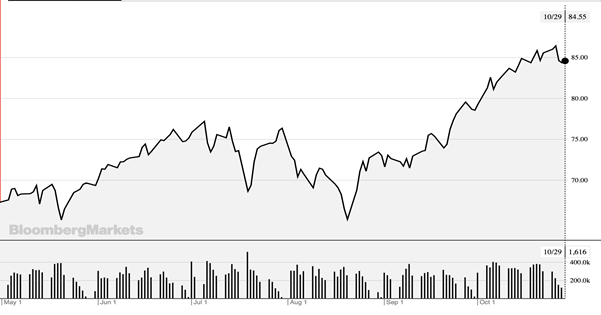

And yet, the S&P 500 is at an all-time high, a third higher than it was before the pandemic. Many believe the S&P 500 is expensive – despite a good third quarter earnings season. The US bond market is, arguably, also expensive (although cheaper than it was) because there are mounting expectations that the Federal Reserve will begin raising interest rates sooner rather than later despite continuing to forecast that the pick up in inflation is transient. Global benchmark US Treasury bond yields increased to 1.6% and the US Federal Reserve is still expected to begin its tapering program in November.

UK gilts signaling sharp rate hikes

Following September Monetary Policy Committee meeting’s narrative, The Bank of England appears decidedly more hawkish. Governor Andrew Bailey has warned that interest rates must soon rise to stem inflation currently running at 3.1%. However, there is clearly a political desire for wages to rise as part of a “high wage, high growth economy”.

The London money markets are pricing in a rate hike to 0.25%, from 0.1%, at the Bank’s next meeting on November 4th, and the price movement in gilts reflects expectations of a further move to 1% by May. This seems like an overreaction, but may reflect the fear that the Bank of England is on the brink of a policy error.

Assuming the Bank of England does raise interest rates to 0.25% this week, does the market really believe that it won’t wait to see the impact on the consumer in the run up to Christmas as well as the effect on the housing market?

The Bank of England’s message also throws up another problem which goes against current market expectations. The conventional wisdom was that, long before there was ‘talk about talking about’ interest rate hikes, quantitative easing stimulus would be wound down. At the very least, the market expected a timetable for stimulus easing.

U.S corporate earnings growth remains resilient

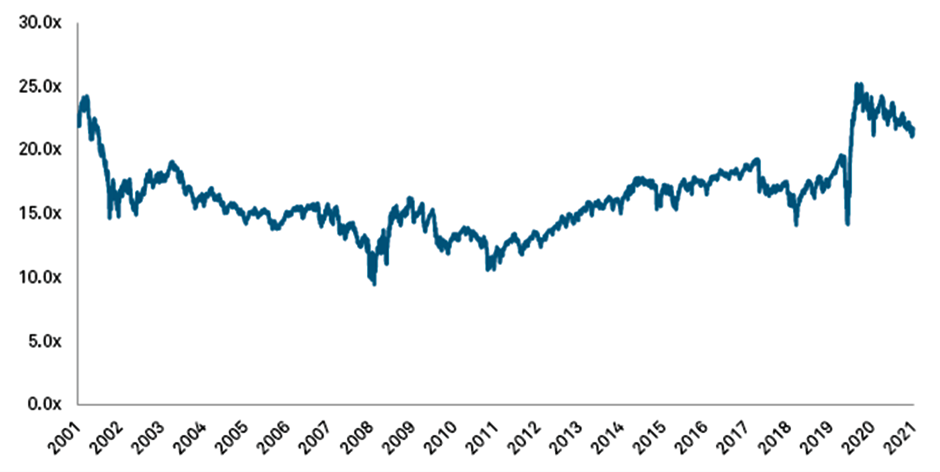

Valuations in developed world stock markets remain extended but market analysts are generally confident that equities will continue to gain ground on strong earnings performance.

Financial companies was the first sector to announce third quarter earnings. Prospects for the sector are viewed favorably — alongside energy — with commodity prices, particularly oil and gas prices, having gained considerable ground in recent weeks on worrying shortages.

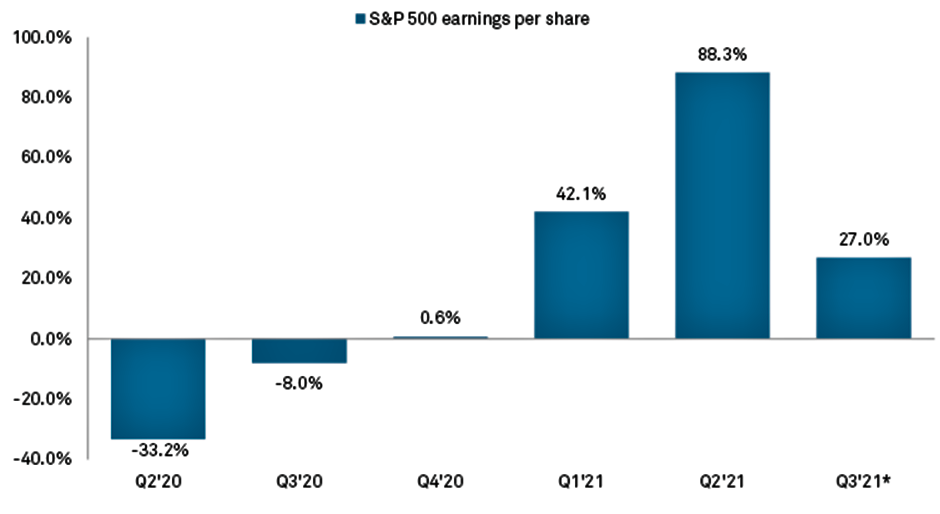

The vast majority of S&P 500 companies that have so far reported have exceeded profit expectations with 88% of financial companies beating forecasts by a wide 21% margin.

Supply shortages and slowing growth dampen optimism

Europeans are bracing themselves for a cold winter based on gas shortages and sky-high prices. In the UK, panic buying of fuel by drivers has resulted in price increases and China has had to contend with a significant shortage of coal, which has necessitated energy rationing in the industrial sector and some residential blackouts.

Supply shortages and delays continue to dog the transport of goods to where they are needed, affecting sectors such as electronics, autos, meat, medicines, and household products. Several US companies have warned of rising costs due to supply chain disruptions, admitting these could have an impact on earnings. Companies that have been least affected include those that have wide product margins and pricing power, including tech and healthcare companies.

The supply constraints stem from a mix of transport restrictions related to the pandemic but also under investment in transport infrastructure and electronics production and a reluctance of workers to return to high-risk Covid-19 sectors.

An emerging concern has been evidence of a slowdown in growth in some of the developed markets production come in much weaker than the market was expecting. This was attributed to hefty declines in the mining and utilities sectors due to one-off weather-related factors.

China’s GDP also came in well below expectations and it is likely to remain under pressure given its energy challenges. The world’s second biggest economy has also seen a rise in Covid infections. These factors may dampen economic activities should they continue.

Inflation revisited

A lack of shipping containers, port closures and delays, a shortage of truck drivers, lack of computer chip production capacity, electricity shortages in China and India, and rising global commodity prices are all likely to contribute to global inflation rising by 1.5 percentage points in Q3 2021, according to OECD estimates.

Euromonitor forecasts global inflation to reach 4% in 2021 before falling back to 3.6% in 2022. In our opinion, a positive year for equity and bond markets in 2022 depends on any further increase being limited.

Outlook

UK rate hikes

Raising the prospect of hiking interest rates before any discussion of the Bank of England’s plans for quantitative easing sends a confusing message to markets. Is inflation temporary? Would higher interest rates be temporary? We all know that the Bank of England can, if it wants, afford to be nimbler than her US cousin, whose policy turns like a fully laden oil tanker. Is this part of their thinking? If it is, then the bond market may have got it wrong in pricing for aggressive UK rate hikes.

Slowing economic growth

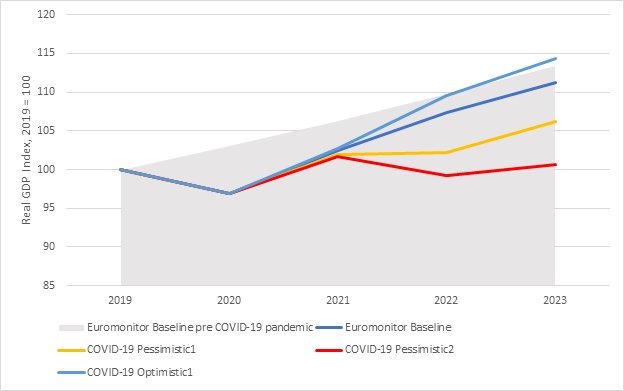

Euromonitor research shows that Covid-19 remains the primary economic concern going forward. It ascribes a 28% probability to a pessimistic Covid-19 scenario in which more infectious and vaccine-resistant variants result in multiple economic lockdowns in 2022.

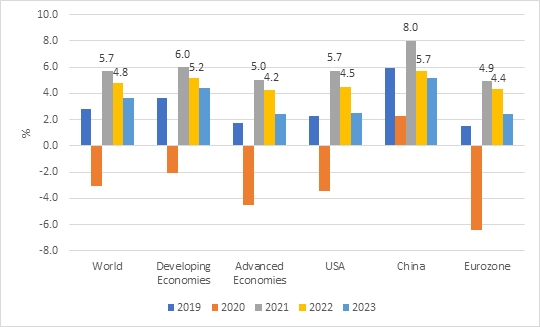

It also points out that global economic growth has deteriorated since mid-2021. Euromonitor expects global real GDP to increase by 5.7% in 2021 (a 0.2 percentage point downgrade since July) and has significantly downgraded 2021 growth expectations for US, China, Asia Pacific economies, although its expectations for the Eurozone are up.

The portfolios’ October performance is as followed:

| Fund Name | Performance |

|---|---|

| International Balanced | +2.87% |

| International Growth | +3.38% |

| Natural Resources | +4.26% |

| Gold & Precious Metals | +7.13% |

Regards,

Euro Pacific Advisors Management Team