Published: September 08, 2021

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold and Precious Metals

- Peter Schiff

Our Commentary

Market overview

August saw stock markets continuing to march higher to a record-beating earnings season, despite the far-reaching spread of the Delta variant raising concerns that global growth may have reached its peak, and we could fall back from here.

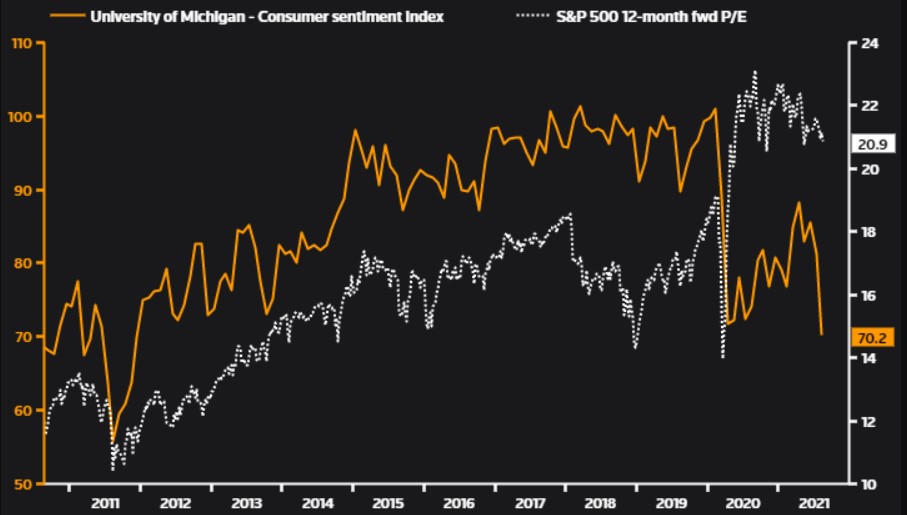

In the U.S., the Dow Jones Industrial Average advanced 1.5% while the S&P 500 was up 2.6% and the Nasdaq lead the way by gaining 3.1% for the month. The S&P 500’s forward P/E, which captured investor expectations 12 months down the line, remained elevated at 20.9, indicating that investors continued to anticipate strong earnings growth.

Across the Atlantic, the FTSE 100 and the Euro Stoxx 50 experienced similar increases of 1.7% and 2.5% respectively. In the Pacific region, China’s CSI 300 Index managed to eke out a 0.4% gain during the month notwithstanding the regulatory clampdown, that sent its technology and online education stocks spiraling lower in the previous months. For the year, it is one of the few stock markets that is still in the red, down by almost 8% year-to-date.

State Street is less confident than Wall Street

While US stock market indices marched higher in August, U.S. consumer confidence took a big knock in the same period.

A cause for concern is that zero-COVID economies such as China, Singapore, Taiwan, Australia, and New Zealand, which have tried to completely stamp out the virus, have seen a renewed rise in infections. This event has undermined many investors’ confidence that the virus will ever be completely vanquished.

A growing pool of expert opinion suggests that COVID is likely to become endemic, much like the seasonal flu, and that we will have to learn to live with it.

Fizzling momentum, waning mood

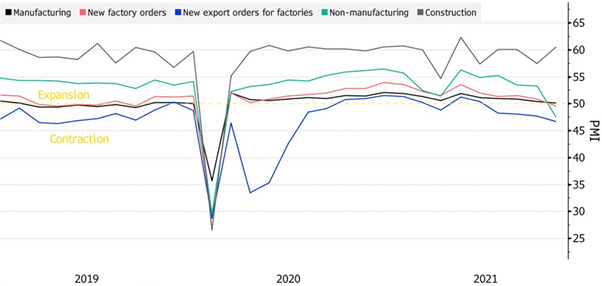

The impact of the Delta variant started to be felt during October of last year, with the rollover of the purchasing managers’ index (PMI) and Citibank’s Global Economic Surprises Index, which reflected whether economic activities were outperforming or underperforming forecasts. To note, the Global Economic Surprises Index has turned negative for the first time since mid-2020. This indicator highlighted waning investors’ mood due to the US and international data releases were missing forecasts at a noticeable rate.

Whether this news has any impacts on future markets returns is unknown, studies has shown that 1% surprise in quarterly GDP growth is associated with 0.7% change in quarterly U.S. equity returns in the last 30 years.

On the other hand, recent PMI data released by the National Bureau of Statistics also showed that China, where outbreaks of the virus have been strictly managed, has experienced economic activity slowdown. The country’s service sector PMI data has also fallen below 50 for the first time since the first quarter of last year, signaling a contraction. Its manufacturing sector and export orders declined in tandem.

US Government debt revisited

Relationship between yield and sentiment

Yield changes highlighted the sensitivity of rates to prevalent investor sentiment. In the first quarter of this year, yields rose on inflation fears. In the second quarter, they fell on concerns of slowing growth. Two months on and investors are still harboring concerns about growth and investors still seem appeased by Powell’s commitment to address inflation as and when needed.

A hot summer for US Treasuries

The perplexing decline in US bond yields continued into August, with the US 10-year Treasury yield remaining below 1.4%, having traded at 1.75% at the end of March. During August, the world’s benchmark interest rate started out at 1.17%, reaching a high of 1.367% around mid-month before ending August below 1.3% again.

The dip in yields was attributed to concerns about slowing growth and uncertainty about whether the US Federal Reserve will begin tapering off its bond buying programs by the year’s end or next year. At the much-anticipated Jackson Hole Symposium towards the end of the month, FED Chair Jerome Powell managed to keep investor sentiment on an even keel by acknowledging that tapering may begin later this year but that it would be conducted cautiously and carefully.

US equity investors took the news in their stride with stock market indices again reaching new highs by the end of the week, while the US Treasury Yield ticked up from its mid-month lows. Expectations of the 10-year treasury yield reaching 2% by year-end were no longer commonplace, although some market commentators thought that it was still possible. According to FactSet data which showed the average forecasts of analysts last month, the 10-year yield was expected to rise to 1.8% by the year-end from 1.31 %. However, Goldman Sachs and JP Morgan have both cut their 10-year yield forecasts to 1.6% and 1.75% by the end of 2021. Citigroup, in contrast, still expected the yield to come in at 2% for the same period.

Portfolio Actions

Despite the fall in yields, there are widespread expectations that inflation is not going away quickly. With investors’ sentiment and PMI reading on a declining trend into August, whether the current stock markets’ growth momentum can be maintained remains a question mark.

Additionally, a market discrepancy that we have noticed is despite improving labor markets booming US economy, interest rates at present levels are not compatible to the current market conditions. What is even more important for investors is the inflection point, in which interest rates are raised to match with the corresponding economic conditions. This event can potentially bring intense volatility to both equity and bond investors’ portfolios. Regardless of the outcomes, our portfolios remain diversified to prepare for such market events.

The portfolios’ August performance is as followed:

| Fund Name | Performance |

|---|---|

| International Balanced | +1.09% |

| International Growth | +0.95% |

| Natural Resources | +0.64% |

| Gold & Precious Metals | -6.27% |

Regards,

Euro Pacific Advisors Management Team