Published: May 13, 2022

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold and Precious Metals

- Peter Schiff

Our Commentary

Market overview

April was the month reality set in for investors that the myriad headwinds facing the global economy and financial markets are not about to alleviate any time soon and could magnify beyond current expectations.

Stock markets sold off sharply in a three-day rout in late April and ended the month deep in the red. The US S&P 500 and Nasdaq led global equity markets downwards, with the former shedding 8.7% and the latter 13.3% in April alone. For the year, the Nasdaq has lost more than 21.1% and the S&P 500 12.9%.

China was also hard hit, extending its losing run that was set in motion last year when the Chinese authorities clamped down on tech and online industries, imposing much harsher regulations on their business activities. This year the world’s second largest economy has been dogged by ongoing Covid flareups, with Shanghai under strict lockdown during April and growing fears that Beijing may be next in line.

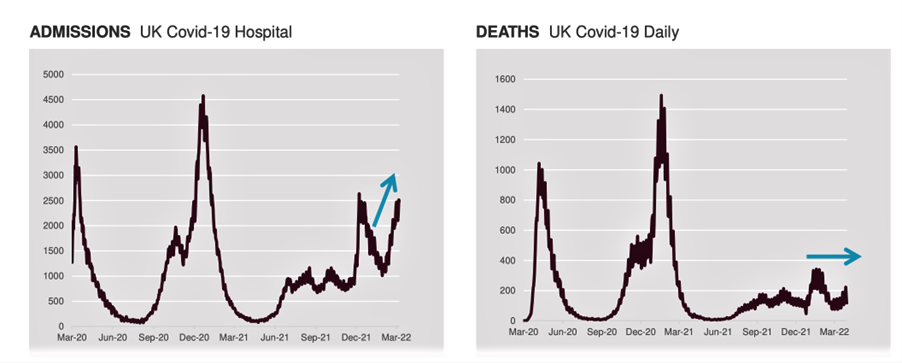

Elsewhere, Covid is proving less disruptive because even though numbers are rising, deaths are not and countries such as the UK are learning to live with the virus in the absence of a new more virulent strain emerging.

Flare-ups less likely but disruptions remain a wild card. Example: UK. Source: FTSE Russell.

Learning to live with inflation

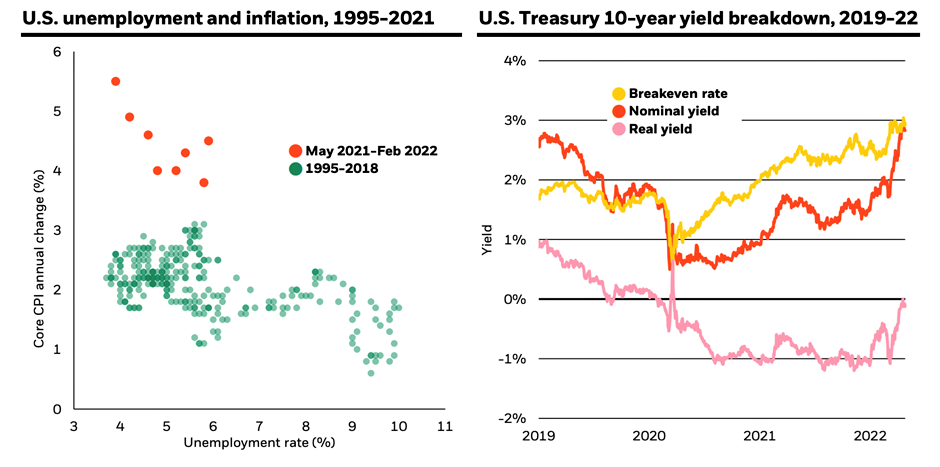

The last several commentaries have identified inflation as the main driver of market movements since last year. In May, the bond markets had one their worst months ever, with yields jumping higher on concerns that the central banks may become overzealous in their implementation of more restrictive monetary policy conditions via higher interest rates and quantitative tightening. In both the US and Europe, indices of bonds with maturity greater than 10 years have declined in value by over 15% YTD.

With inflation at forty-year highs, the US Federal Reserve is still on track to raise the federal funds rate by at least 50 basis points at its next meeting. Moving forward, there is a growing argument that the Fed will take into account the potential for monetary conditions to tighten for other reasons, and that inflation is close to peaking.

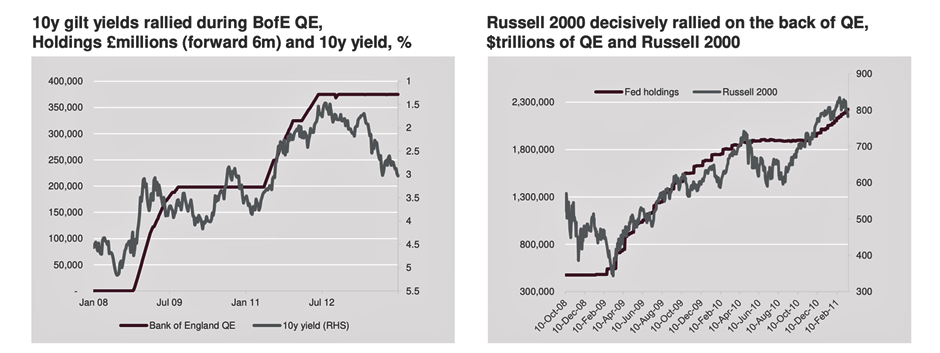

BlackRock and FTSE Russell see the central banks as learning to live with inflation. Notwithstanding projections of a series of rate hikes this year, they believe the central banks are likely to maintain low real yields, cognisant of the risks of reversing their quantitative easing policy too sharply. Excessive tightening could destroy demand and lead to a rise in unemployment.

Despite the hawkish tone, central banks will be wary of raising rates too quickly.

Central banks are highly aware of the positive effects that QE has brought and equally aware of the risks of reversing the policy. Source: FTSE Russell.

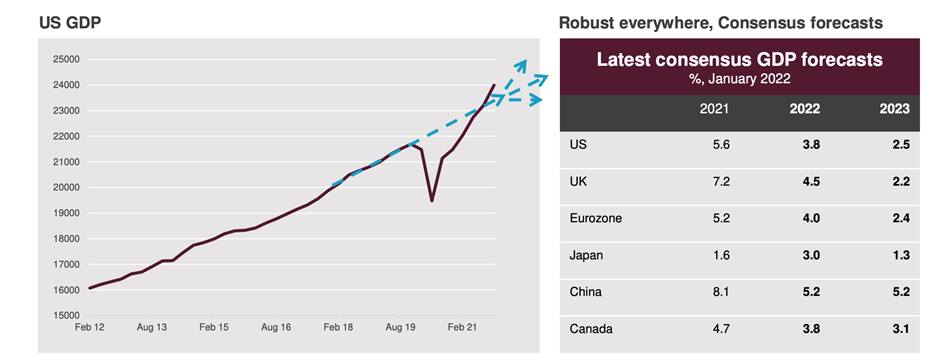

Downgrading growth forecasts

The IMF, the World Trade Organization and private sector economists are still factoring in a material slowdown in the global economy this year, downgrading their growth forecasts to reflect inflation, hawkish central banks, the ongoing Ukraine-Russia war and extended supply constraints, with China still set on maintaining its zero-Covid strategy.

The IMF downgraded its economic growth forecasts across 143 countries that account for 86% of global GDP, with global economic growth now expected to come in at 3.6% in both 2022 and 2023 – 0.8 ppt and 0.2 ppt lower than the growth projected in January this year.

The WTO is even more pessimistic, expecting world GDP to increase by a mere 2.8% this year and to pick up to 3.2% next year. The Peterson Institute for International Economics (PIIE) predicts that global economic growth will come in at 3.3% in both 2022 and 2023.

Clearly, recession is still not a base-case scenario but Europe is perhaps the region most vulnerable to this downside scenario. Despite the sharp deterioration in investor sentiment of late and material downgrades in growth forecasts, the world economy is still expected to avoid recession this year.

Optimistic backdrop: Rate-hike expectations have been fueled. Source: FTSE Russell.

U.S. elections loom on the horizon

Ahead for the US are the mid-term elections in November, which will inevitably affect the mood of the electorate. The prevailing view is that Republicans could well take back both chambers of Congress, which could result in policy gridlock.

Although markets tend to take such outcomes in their stride, it may increase volatility as policy differences become more apparent.

Republicans taking control of the House and the Senate is likely to result in fewer tax changes, greater increases in defence spending, fewer green initiatives and some contentious negotiations around the debt ceiling. That compares with the status quo, namely a moderate increase in defense spending, further climate bills aimed at putting in place green incentives and an easier path to raising the debt limit. We will doubtless see greater focus on the implications as the time nears.

Outlook

For opportunity seekers, April’s market volatility may prove to be a good thing. After years of being overlooked by investors who were seduced by handsome equity gains, the bond market may become attractive again as the yield on the 10-year Treasury note rose above 2.9% this month, notching more than 25% in gains.

As we are approaching the tail end of this economic cycle, some investor camp thinks it is not too early to be prepared for recessions by shifting to traditional defensive strategies. On the other hand, optimistic investors who still believe that the current bull market still have some legs may find hidden gems in the tech market, which is still reeling from rate hikes news and inflation.

We are currently adopting the wait-and-see dynamic in May. Additionally, by maintaining a small percentage of portfolios’ weight in cash (less than 10%), we may be flexible if attractive investment opportunities emerge for short-term plays.

The portfolios’ April performance is as followed:

| Fund Name | Performance |

|---|---|

| International Balanced | -5.59% |

| International Growth | -6.15% |

| Natural Resources | -2.61% |

| Gold & Precious Metals | -7.59% |

Regards,

Euro Pacific Advisors Management Team