Published: January 14, 2022

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold and Precious Metals

- Peter Schiff

Our Commentary

Market overview

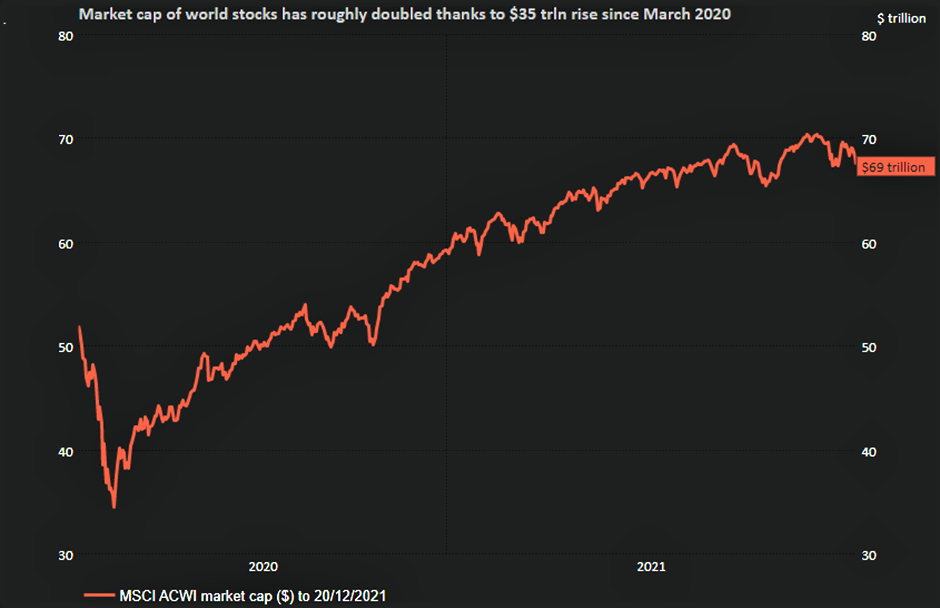

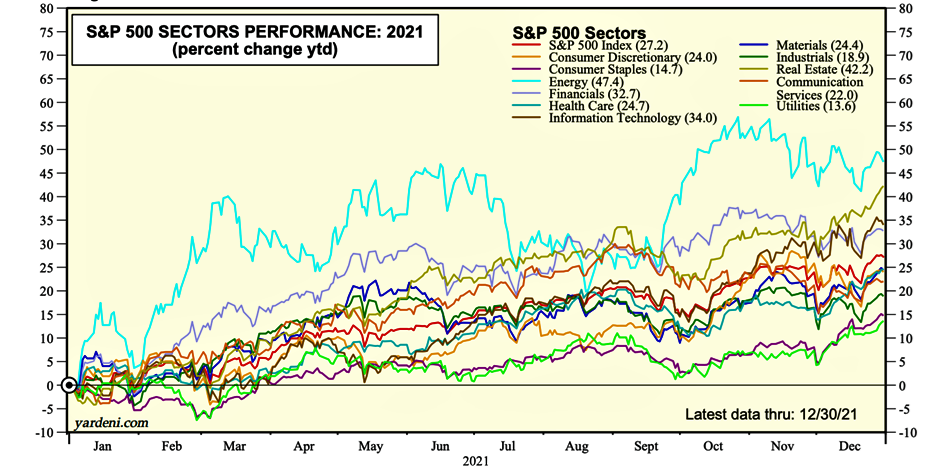

Most stock markets gained ground in December to wrap up a year, in which equities went from strength to strength while bonds and gold lost value. The S&P 500 rallied a staggering 27% during the year, European and UK market gained over 15% while China was the standout underperformer, sliding 5% after Chinese regulatory clampdowns raised investor concerns about the world’s second largest economy.

US companies had strong third quarter earnings and the fourth quarter is expected to be equally impressive. Earnings growth for the year is expected to be 45%, significantly greater than the 22% growth anticipated a year ago. However, with the S&P500 price to earnings ratio at 28.9, the jury is out on whether similar increases can be achieved this year.

The sectors that outperformed in 2021 were energy – which had a runaway streak from mid-September – financials, real estate and information technology. According to Bank of America, about 65% of the Nasdaq’s gains can be attributed to five tech stocks – Microsoft, Google, Apple, Nvidia and Tesla.

Macroeconomic concerns remain

The stellar stock market increases occurred against an uncertain macroeconomic picture, which has faced global supply challenges, rising inflation and central bank moves to start withdrawing trillions of dollars of liquidity that have been propping up the financial markets and buoying investor sentiment.

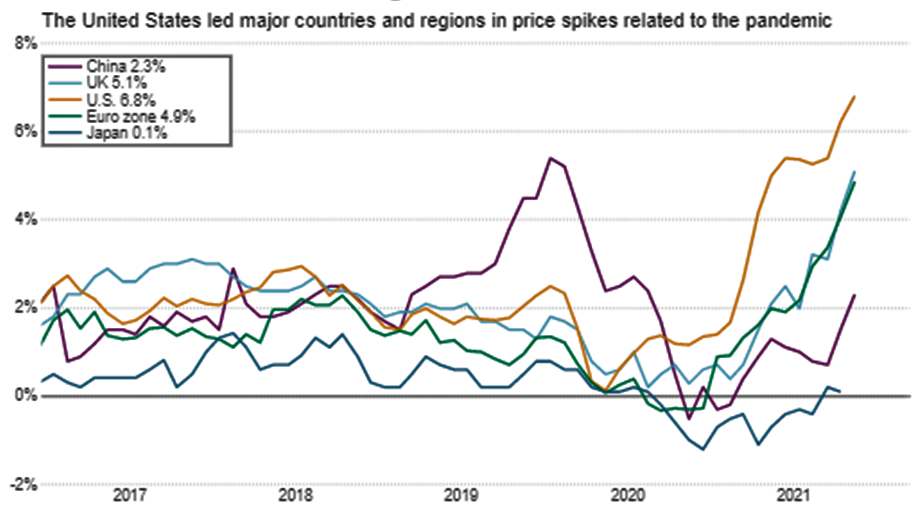

A significant rise in consumer demand for goods, Covid-related bottlenecks caused by port shutdowns in China and other logistical hiccups led to supply constraints which fed rising prices. These also saw microchips in short supply, with the impact felt across the manufacturing sector and auto companies the hardest hit.

Inflation took over as public enemy number one after initial hopes that supply would catch up with demand after a few months. Considered transitory by most mainstream economists and the Federal Reserve for most of the year, US Federal Reserve Chairman Jerome Powell formally put the term out to pasture in early December, acknowledging that inflation was likely to remain higher for longer.

As a result, the Federal Reserve is increasing the pace of its monetary policy tightening to ensure inflation expectations don’t become entrenched and set in motion a self-fulfilling cycle. The central bank began tapering in November and now expects the process to be over earlier than its original June target date. Chairman Powell also indicated that financial markets could expect up to three rate hikes in 2022.

In the UK, the Governor of the Bank of England guided the financial markets to expect a rate hike in November but did not deliver, causing significant bond market volatility. Interest rates were raised in December. The European Central Bank remains more dovish.

Central banks will have to maintain the delicate balance between keeping inflation expectations anchored and allowing for a supportive environment for economic growth. As negative supply shocks push inflation higher, they threaten to set off a self-fulfilling cycle of ever higher inflation, which could begin to chip away at demand.

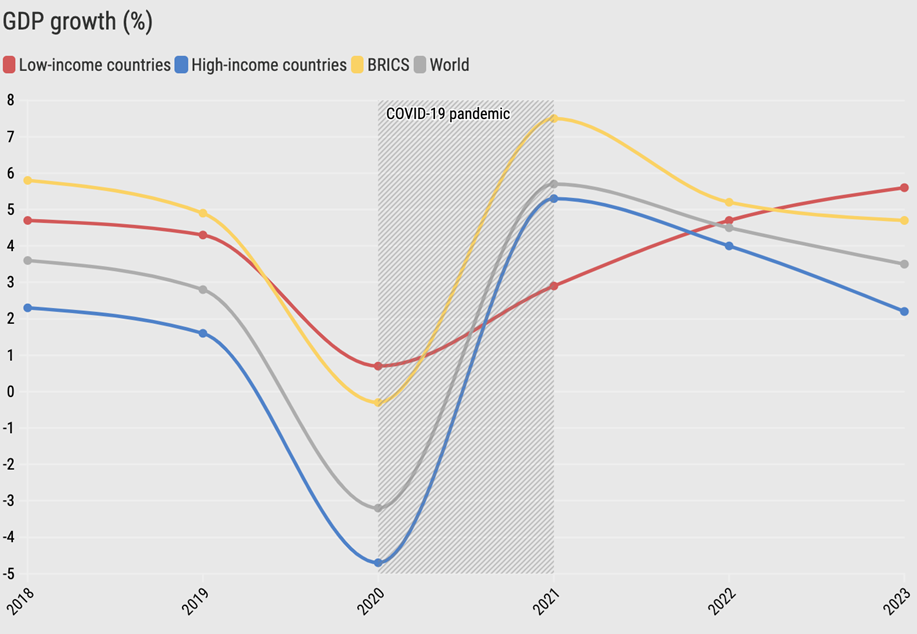

While the global economic recovery continued, the World Bank raised concerns about the uneven rates of recovery, as shown in the graph below. High income countries have managed to recover at a healthy rate and are expected to continue on their upward trajectory. In contrast, low income countries have lagged.

The OECD expects a rebound in global economic growth to 5.6% this year and 4.5% in 2022, before settling back to 3.2% in 2023, close to the rates seen prior to the pandemic.

Omicron’s appearance in December raised economic concerns but hopes that that measures to limit the spread may be more restrained than for previous variants meant financial markets recovered ground and the oil price, which came off $10 a barrel on the day Omicron hit the news, recovered rapidly.

Gas prices rise due to shortages

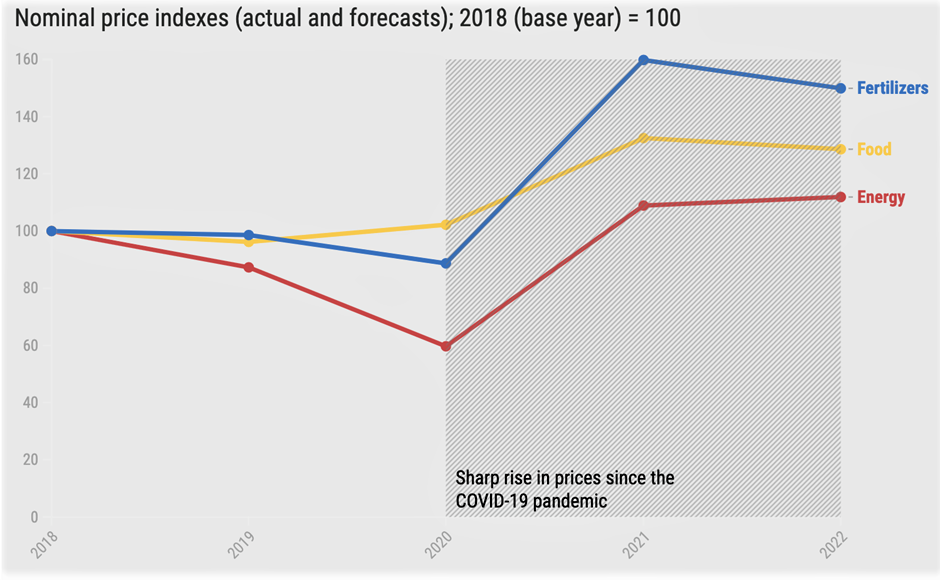

Since Autumn, gas prices have spiraled in response to global supply shortages. Record high natural gas prices in Europe and Asia were spurred by significant demand ahead of the northern hemisphere winter and unanticipated shortfalls in existing renewable energy production. They were also affected by the geopolitical forces stemming from what is seen as Russia’s attempt to force Europe’s hand by restricting supplies so that it will approve the Nord Stream 2 gas pipeline.

Europe relies significantly on natural gas from Russia and now has to compete with South East Asia for liquid natural gas exports from the US, where there is pressure to halt exports. Most economies, including China, are likely to transition to gas in their journey to becoming net-zero economies and thus demand is only likely to intensify over the next decade.

Portfolio Actions

Despite December gains, we think markets will be under pressure going to the first quarter of 2022. A few media camps have discussed about the possibility of a market correction in January. We think the possibility of such event’s occurrence is low.

The portfolios’ composition remains unchanged for the month, while we are currently maintaining a comfortable degree of cash in all portfolios (<10%) in case investment opportunities arise. Our December and annual performance are as followed:

| Fund Name | Performance (December) | Annual Return |

|---|---|---|

| International Balanced | 1.74% | 0.62% |

| International Growth | 2.19% | 3.83% |

| Natural Resources | 1.42% | -0.19% |

| Gold & Precious Metals | 2.06% | 20.80% |

Regards,

Euro Pacific Advisors Management Team