Published: June 08, 2021

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold and Precious Metals

- Peter Schiff

Our Commentary

Monthly recap

Stock markets, commodity prices and cryptocurrencies all experienced a volatile May, first climbing strongly and then selling off sharply as inflation fears surged and then subsided.

Headline US consumer price inflation came in at 4.2%, well above the US Federal Reserve’s 2% average target. Cars and food were the main inflation drivers with the 10% month-on-month increase in the price of used cars contributing one third to the overall increase in the Consumer Price Index (CPI).

The steep increases in commodity prices have also contributed to upward price pressures globally, with the Bloomberg Commodity Index 17.2% up for the year to date. The copper price has seen the highest gains of the commodity basket due to its use in renewable energy solutions although it did retreat from highs achieved earlier in May.

Semiconductor-pull inflation?

Central bankers and economists are convinced that supply shortages in key areas of the economy are behind many of the price increases. While these may continue into the third and fourth quarters, their view is that these will not have a persistent effect on prices as manufacturers adapt to post-COVID-19 demand levels.

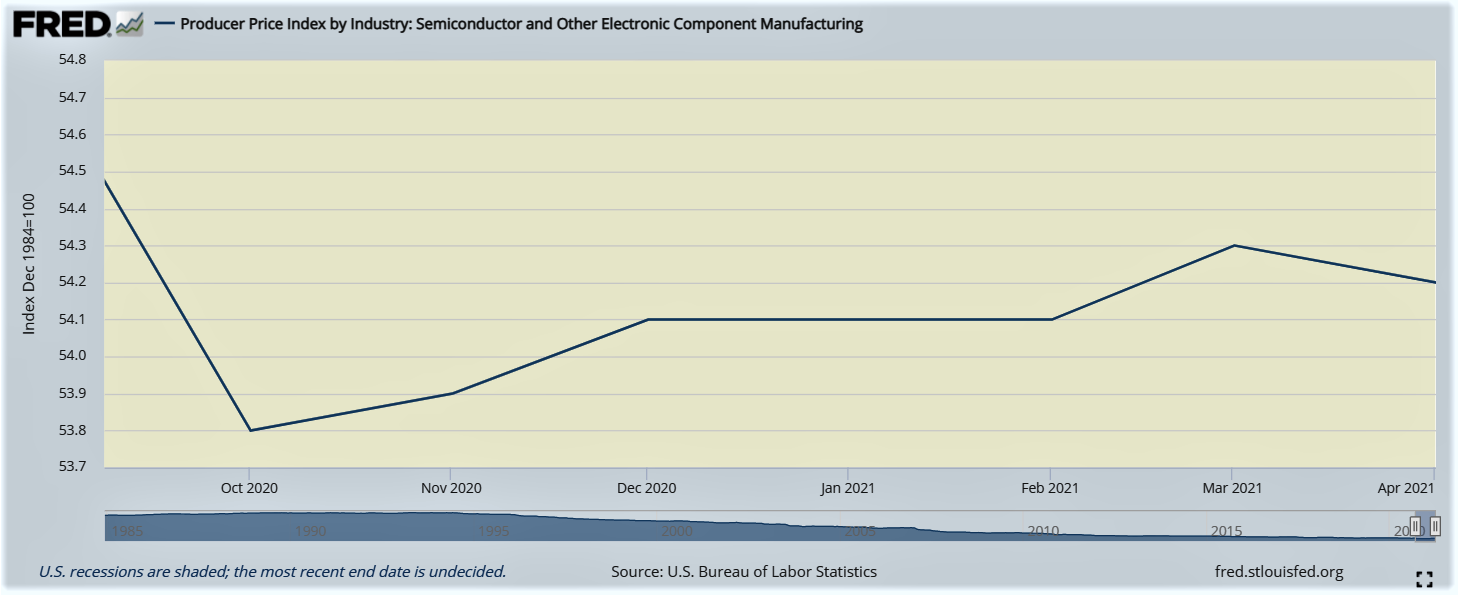

The most acute supply shortages have been in semi-conductors. The shortage has affected a broad swathe of manufacturers in industries ranging from autos to smartphones to white goods such as washing machines. Contributing to the rising price of semiconductors is the hoarding of chips by manufacturers eager to ensure they have sufficient supply in a period of uncertain demand.

As worries about supplies have mounted, so have concerns about chip production, the bulk of which occurs in a limited number of countries and by a handful of suppliers. With shortages expected to last for at least the next few months, Goldman Sachs has estimated that at least 169 industries have faced disruption with a potential 1% negative impact on US GDP this year.

Uncertainty in the cryptocurrency market

Highlights

The assets dominating the news and proving most volatile in May were the cryptocurrencies, with Bitcoin (BTC)* holding the highest profile.

BTC price in April had shot up to almost $65,000 when Elon Musk, the CEO of Tesla, Inc., went public about making a $1.5bn investment into the world’s largest cryptocurrency. The coin then crashed after he criticized the energy consumption associated with its mining interests and announced that Tesla would be suspending payments using the Bitcoin token.

After selling off to below $32,000, the price recovered a little to end the month at around $38,000. It remains more than 350% higher than a year ago.

Causes of crypto volatility

Besides Musk’s unpredictable commentary, Bitcoin’s fortunes were adversely affected by the tough regulatory stance adopted by the Chinese government when it warned financial services companies that they were not allowed to accept Bitcoin payments. China also reiterated its commitment to positioning its Central Bank Digital Currency as the digital payment of choice.

While many believes that price movement in the crypto space are indicators of future stock performance, we are skeptical about this thinking’s merit but we are open-minded about the possibility of correlation between these two asset classes.

Outlook

Events in May highlighted that, until the global economy and financial markets have come out the other side of the pandemic, sentiment will remain extremely volatile.

For the rest of the year, global economic growth, which is showing very little sign of waning, may well remain a fundamental underpin for stock markets. One cloud on the horizon for corporate earnings is the impact of President Biden’s proposed tax increases, but for now the focus is elsewhere.

Portfolio Actions

The month of May witnessed positive performance by all of our funds:

| Fund Name | May's Performance |

|---|---|

| International Balanced | +1.44% |

| International Growth | +1.74% |

| Natural Resources | +3.70% |

| Gold and Precious Metals | +10.95% |

Our portfolio managers increased the cash position slightly in May. The portfolios tends to keep a small cash element, also known as the Tactical Element, to take advantage of short term opportunities in the market. Beyond that, we continue to ensure that our core strategies are well-diversified and our commodity funds track their respective benchmarks.

Regards,

Euro Pacific Advisors Management Team

*Note that our funds do not hold cryptocurrency.