Published: December 15, 2020

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold & Precious Metals

- Peter Schiff

Our Commentary

November Review

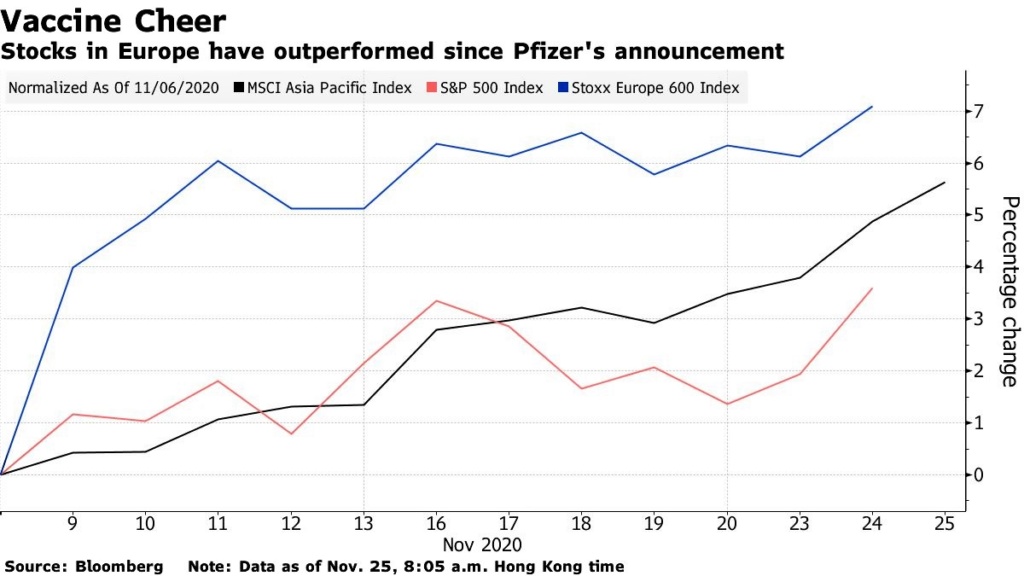

In November, a Biden projected win in the US elections and Pfizer breaking the news that their positive trial results saw most global stock markets rally strongly, with European stocks leading the way:

Following that first breakthrough, three companies came through with vaccines purported to deliver better-than-expected success rates at combatting COVID-19. This event has buoyed expectations of a global economic rebound from as early as the second quarter of 2021 onwards.

A large part of the developed world’s population may be vaccinated by the middle of 2021 and the prospect of seeing an end to the pandemic saw the US Dow Jones Index breaking 30,000 for the first time.

The US elections also proved positive for US stocks, with expectations that a Biden administration would deal more decisively with the exponential rise in infections experienced during November. A Biden presidency is also expected to place combatting climate change back on the federal government’s agenda, and the administration will take a more positive stance on global trade.

A lasting and unexpected effect of COVID

For all its economic damage, COVID-19 has had a profound effect on investor and broader societal attitudes towards sustainability. The pandemic has been an eye-opener for many investors regarding the genuine risks posed by the ‘S’ in Environmental, Social and Governance (ESG) investment considerations.

Until now, the focus has been on environmental and governance. But the pandemic has put the spotlight on social sustainability. The health crisis prompted companies to take labor standards, gender equality and human capital management seriously as they have had to prioritize the mental and emotional health of employees in the shift to remote working.

These realization further strengthens our view that ESG funds will become more popular as investors are catching up to this emerging trend.

Assets in ESG funds reach record levels

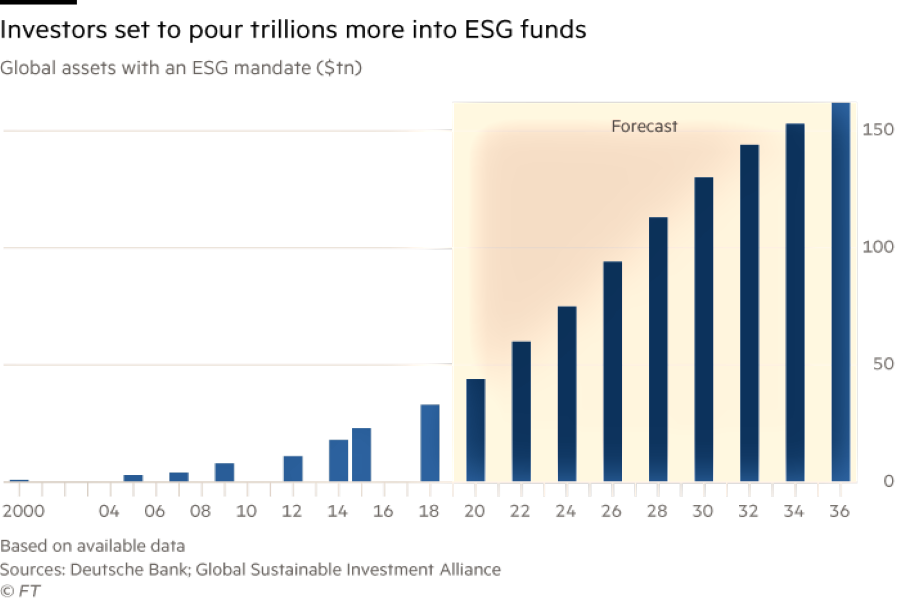

Against this backdrop of changing perceptions of the role green investments can play in delivering sustainable performance in the future, significant funds have flowed into ESG and other green investments this year. Morningstar figures show that some €52.6bn was invested in ESG funds during the third quarter of 2020, increasing assets under management in ESG funds to a record €882bn.This burgeoning appetite for sustainability has also seen the launch of a significant number of new ESG funds.

According to a recent report by PwC, assets under management in ESG equity funds in Europe could grow to between €2.6trn and €3.6tn in the next five years – potentially comprising almost 60% of European investment funds.

A critical factor that will determine ongoing growth in demand for green investments will be whether these investments perform at least in line with (and hopefully ahead of) investments that don’t prioritize ESG.

Morningstar’s research found that European equity funds with higher sustainability scores have generated better risk-adjusted performance since 2016. On risk specifically, it found that the level of sustainability was negatively related to the value at risk (VaR) of the fund, which means that funds that have higher sustainability scores are less prone to experiencing extreme losses.

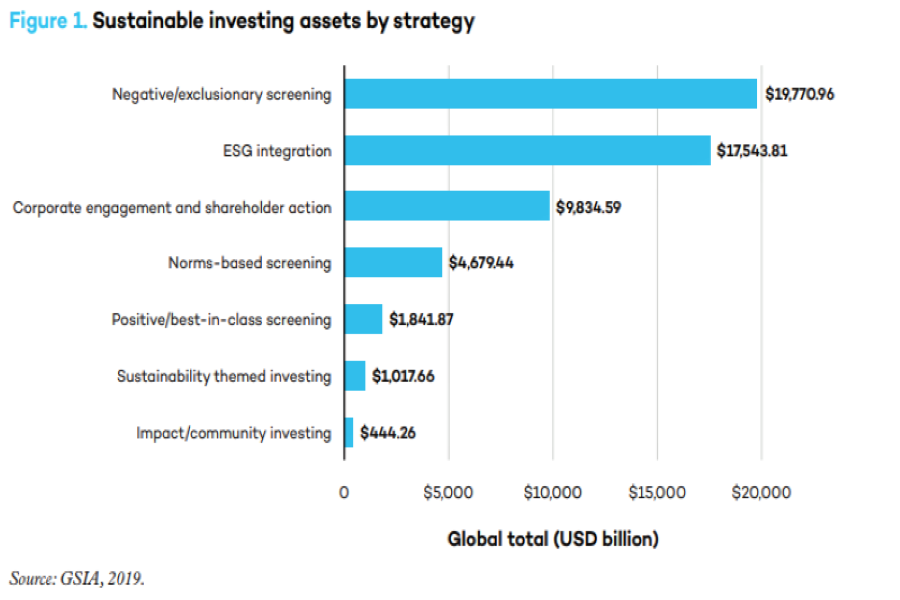

This year, the performance of funds with a sustainability focus has been robust and most sustainable funds have outperformed non-ESG funds over one, three, five and ten years. Of course, sustainable investment strategies are not a homogenous group, as highlighted in the graphic below.

Green or ‘greenwashed’?

The unprecedented growth in demand for green investments has inevitably been accompanied by skepticism about the extent to which companies and investment managers may be engaging in ‘greenwashing’ – overinflating actual sustainability actions and achievements. Earlier this year, for example, Ryanair Holdings’ claim to be “Europe’s lowest-emissions” airline was challenged by the Advertising Standards Authority, which ruled the claim could not be backed up.

It is particularly hard to detect whether investment managers are fully incorporating the spirit of ESG considerations into their investment processes or whether they are paying lip service to these whilst doing little to take the actions that deliver positive sustainability outcomes.

Underpinning the momentum behind green investing is the fact that sustainability is at the heart of the recovery plan for many governments. Investments targeted by these plans include large scale renewables, clean transport, sustainable food, and shortening and diversifying global supply chains.

Implications

With COVID-19 inadvertently offering a window into the devastating impact a big-ticket environmental or social crisis could have on the world as we know it – with profound implications for the financial markets – the demand for green is unlikely to dissipate. It is easy to envisage a time when being green is so ordinary that it is no longer a differentiating factor.

Until then, the hard work will be in determining whether funds are genuinely green or whether they are merely engaging in greenwashing to benefit from the wave of demand for funds that invest for the good of all. Consequently, we prefer not to put ethical labels on our portfolios or to invest in funds purely because of a green label. Instead, we use analysis of the underlying components and factor in sustainability scores as part of our overall investment process. Evidence increasingly demonstrates the investment merits of this approach, in addition to the broader benefits.

Portfolio Actions

While the recent vaccine breakthrough and a Biden victory in the US elections have positive economic implications for European and US equities, we will await more positive data to verify economic recovery signs before rotating out of emerging markets equities.

Our International Growth and International Balanced Fund maintains an equity tilt towards companies that focus in ESG criteria—environmental, social and governance.

For International Balanced Fund, we have replaced both the US TIPS and the US Treasury 3-7 year bonds with an increased allocation to corporate fixed income for International Balanced Funds. This change is designed to increase the return profile of this asset class while incorporating an ESG element.

The iShares Global aggregate bond invests in government, corporate and securitised bonds which are diversified across the globe. All exposure in this asset is to investment grade bonds. This still incorporates US treasuries but increases the corporate bond aspect.

The iShares USD Corporate Bond SRI 0-3 year investment provides short dated exposure denominated in USD to investment grade corporate bonds across several sectors. The company debt is screened and only includes those with a top 4 MSCI ESG rating and excludes many issuers involved in weapons, tobacco, adult entertainment, gambling and nuclear power to name a few.

Regards,

Euro Pacific Advisors Management Team