Published: November 13, 2020

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold & Precious Metals

- Peter Schiff

Our Commentary

The pandemic, US elections, and Brexit see investors adopt a risk-off stance.

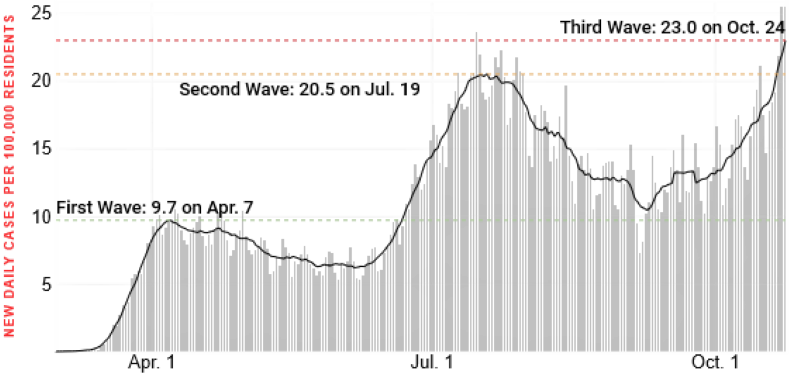

An exponential rise in COVID cases across the developed world – particularly in the latter half of October – weighed heavily on financial markets, with already jittery investors taking risk off the table in the weeks before the US election.

COVID daily infections are reaching record highs and further nationwide lockdowns loom. Hospitals are fast filling up and in Belgium there is already talk of doctors having to make judgement calls on who will be accommodated in ICUs that are already reaching peak occupancy.

Brexit & Developed Markets

European politicians are hard at work trying to negotiate a Brexit deal. The main sticking points remain fishing access to UK waters and mechanisms to resolve future disputes. There is, however, cautious optimism that a deal will be struck in the first two weeks of November, even if it is little more than a narrow trade deal. Ratification of a final deal would likely provide a fillip to UK stocks as long as the stock market is not overshadowed by the pandemic.

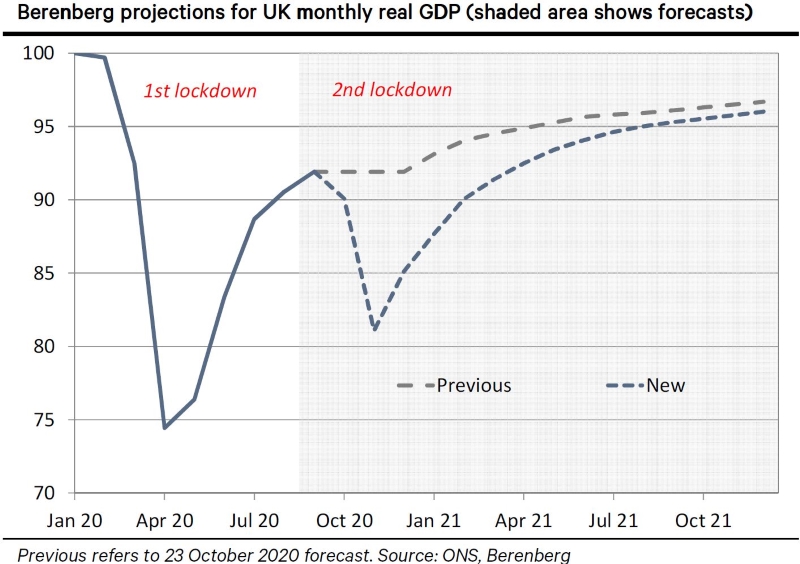

In spite of stagnation in Q4, investment bank Berenberg now forecasts UK GDP to drop by 5.5% resulting in an annual contraction of 11.8%. In the graph below, it forecasts an annual contraction of 7.4% in the Eurozone. The rebound next year in the UK is now forecasted to be sharper at +6.4% but much will of course depend on the timing and success of any mass vaccine rollout.

European and UK stock markets are still deep in the red year-to-date, with the Euro Stoxx 50 Index down 21% to the end of October and the FTSE 100 Index down 26%. Surging coronavirus infections and the ongoing efforts to reach a Brexit deal against all odds resulted in the European index falling 7.3% during the month and the UK by 4.5%.

US declines were smaller, despite disappointing reports from a number of the tech giants.

Emerging markets continue to shine.

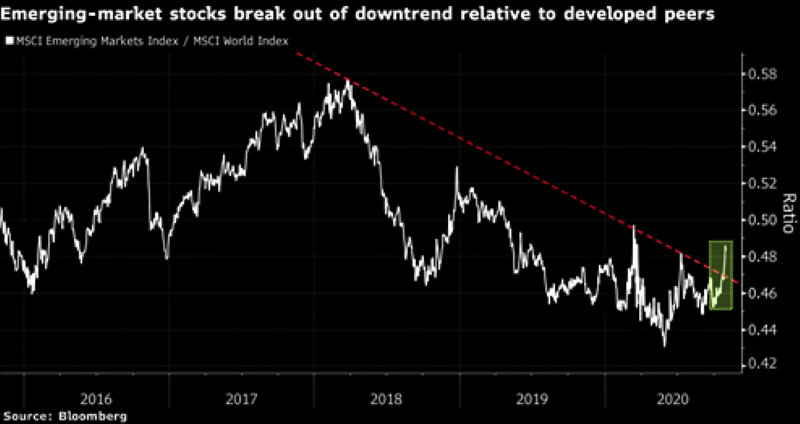

Against the worrying backdrop caused by the pandemic, emerging markets are doing well compared to developed markets. The Bloomberg graph below shows performance of stocks in emerging markets compared to their peers in developed markets. The relative strength of emerging market stocks has broken out of a downward trend present since 2018 and the index is now outperforming its developed market counterpart.

The rally is being driven by China’s more positive economic performance and prospects, as well as the region’s better track record in preventing coronavirus infections from getting out of control again.

While shifts to risk-off sentiment continue to weigh on emerging markets, opportunities remain. Last month, Citigroup recommended that investors rotate out of European equities and into emerging market equities. The group’s own Economic Surprise Index shows disappointment in European equities as a result of the resurgence in coronavirus cases.

In contrast, it points to robust emerging markets and notes attractive valuations and inflows. Similar positive indications have come from the IMF’s GDP forecasts for 2020 which puts Emerging and Frontier economies at -1% with advanced economies languishing at -6%.

Defensive assets such as gold stay mute while oil’s performance remains sluggish.

Surprisingly, traditional safe havens, including US treasuries, the Yen, and gold have not been the beneficiaries of risk-off sentiment. Gold is usually a beneficiary of risk-averse investor behavior but the price eased 0.8% during October.

Oil prices remained on the receiving end of concerns about lockdowns and the impact this will have on global demand. Brent crude oil slipped almost 9% during the month, while the broader commodity universe, as reflected in the Bloomberg Commodities Index, managed to eke out a 1.2% advance but remains 11.2% lower for the year to date.

US Elections

A Biden presidency might signal higher taxes and a shift back towards a more multi-lateral approach to political and economic affairs – adjusting the America First stance pursued by current President Donald Trump during his four-year term. It would also herald regulation more aligned to Europe and a greater focus on anti-trust issues.

A Trump win would see more of the same arm’s length, if not acrimonious, approach to globalization and to China and EU relations, a continued threat of tariffs and sanctions on European goods and manufacturers and possibly the prioritization of a post-Brexit trade deal with the UK at the expense of the Eurozone.

With so many health, economic and political uncertainties at play, the outlook for the rest of the year remains highly unpredictable.

Portfolio Actions

Our strategy for International Balanced and Growth portfolios is shifting away from unstable and sluggish economies and reinvesting our cash into emerging markets with potential growth during and post-COVID 19. Geographically, we have removed our exposure to India while reducing our positions in Europe and Japan.

Protection-wise, we have boosted our exposure to gold which will act as an inflation hedge in the face of a money printing spree by central banks around the world to stimulate their battered local economies. Additionally, the move will increase protection for our portfolios in the case of unforeseen catastrophic events.

In terms of stock picks, our strategy is refreshed with a focus in the ESG criteria—environmental, social and governance. Companies with good ESG ratings will likely become preferred holdings, while the portfolio weights of poorly-rated ESG rated companies will likely be reduced. This factor will drive the long-term performance of global and domestic organizations that pay attention to this shifting investor demand—a new focus beyond the short-term financial gains typically favored in the past, to the long-term well-being of the people and the environment.

Regards,

Euro Pacific Advisors Management Team