Product Updates & Enhancements

GTS Mobile improvements

New trade ticket in GTS Mobile

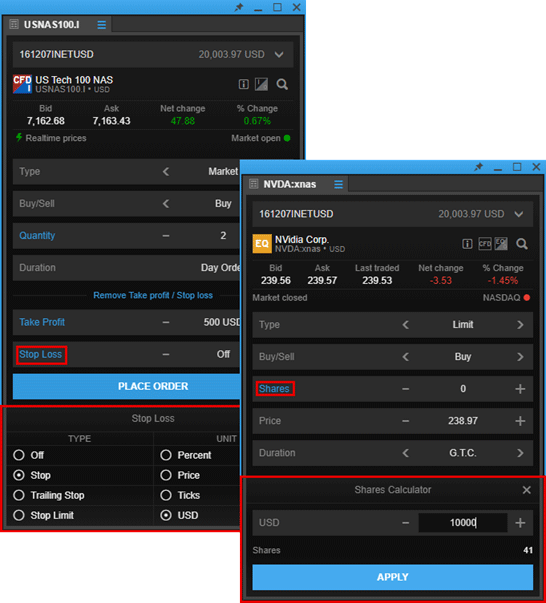

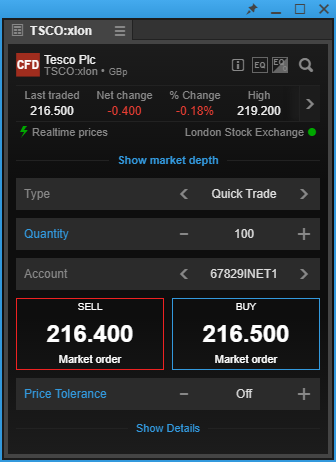

A new trade ticket is now available in GTS Mobile aligning the trade tickets across the web platforms. The new trade ticket offers GTS Mobile users a number of recent enhancements including:

- Second currency FX spot trading: clients can set trade amounts in the second currency

- Take profit / stop loss in account currency: allows take profit / stop loss orders to be defined as profit or loss amounts in the account currency (in addition to instrument price, distance in % or distance in Ticks / PIPs)

- Persistence of input fields: saves input field values for each instrument when a trade or order is placed, persisting them the next time the instrument is selected

- Market depth in Trade Ticket: for clients subscribing to level 2 market data from an exchange, market depth is now also shown in the Trade Ticket for reference

- Keyboard support: to efficiently enter trades and orders with basic keyboard support in the Trade Ticket

- Share calculator: to select a number of shares (or units of the instrument being traded) from a trade amount in the currency of the selected trading account.

Account selector

For clients that have multiple trading account, the account selector in the Trade Ticket has been moved from the top of the Trade Ticket to be next to the trade buttons.

Margin monitor (now available)

A new margin monitor is now available through the GTS Web and GTS Pro platforms for monitoring the impact of scheduled coming margin changes on the client’s account.

The margin monitor is available from the account toolbar (account summary in GTS Pro) if margin changes are scheduled which affect the client’s account.

The margin monitor lists any positions affected by margin changes. The margin simulation includes all changes up to the displayed date and time.

In this example, the Amount would normally be placed in EUR but you can now select to place the trade in JPY which will be converted to the EUR amount when you place the trade.

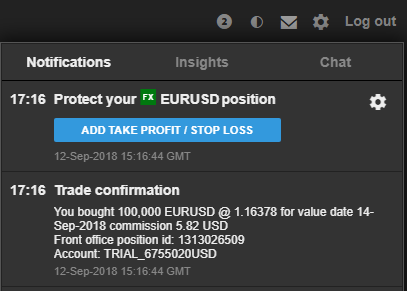

Stop loss / take profit reminder (from November)

A new feature will soon be available in the GTS Web and GTS Pro platforms which reminds clients to add take profit and stop loss orders after placing a trade.

If no orders already exist for the instrument, a notification is shown after placing a trade with a button which opens the Add Related Orders dialog for the position.

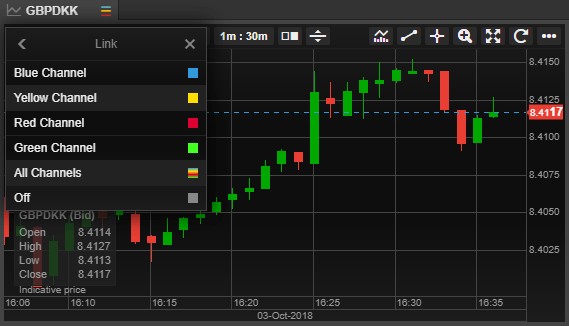

Multi-channel linking on GTS Pro

GTS Pro offers linking of modules for quick switching of instruments, for example to an instrument selected in the watchlist, positions list or orders list.

GTS Pro now expand on this functionality to offer multiple channels for more sophisticated platform linking strategies including:

- 4 different independent channels for linking modules directly together

- All Channels to link a module across all the independent channels

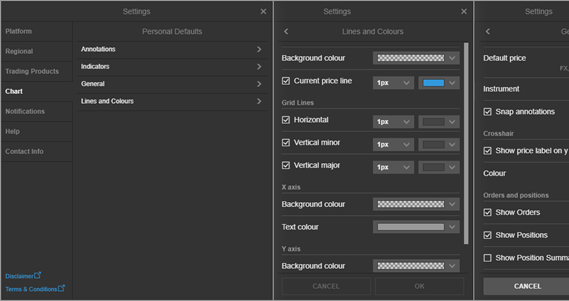

Chart default settings

The chart in the GTS Web and GTS Pro platforms now offer the ability to set the settings for new charts when launched in the platform.

Default Chart Settings allows you to set the default properties for:

- Chart type

- Annotations

- Indicators

- General settings

- Line colors and styles

You can access Default Chart Settings through

- the platform settings

- chart settings

- right-click > Chart setting in the chart

Operational Changes

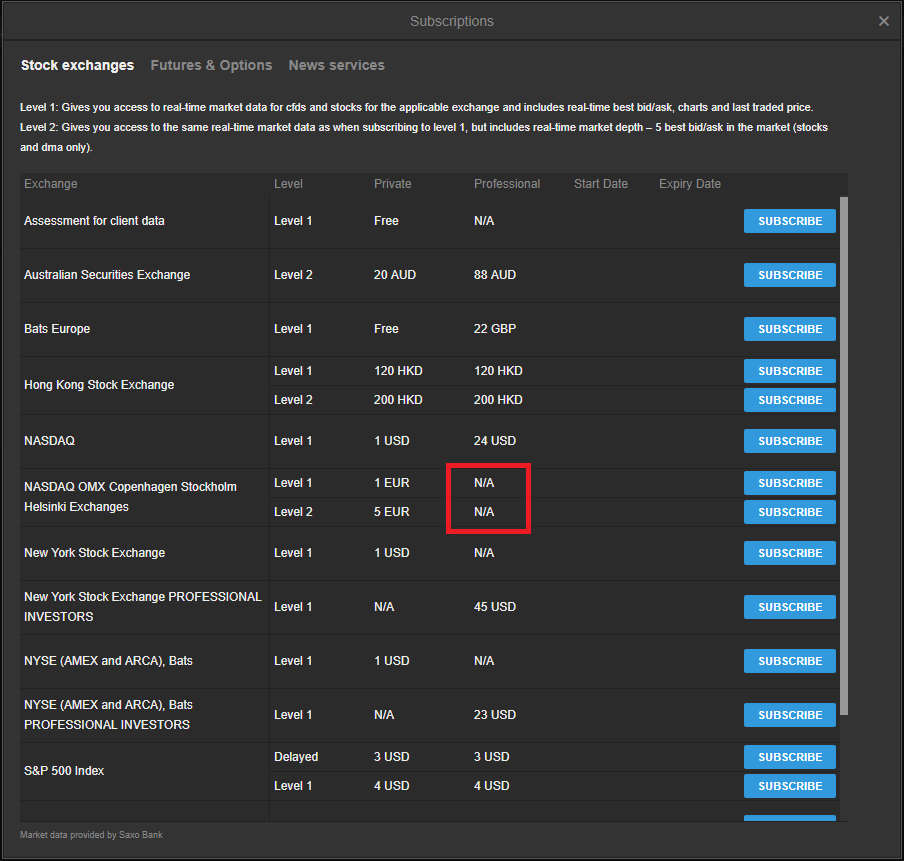

Subscription Changes

Removal of Non-Professional Subscriptions to Nasdaq OMX Nordic Equities for both live and delayed data

From Jan 01st 2019, xisting subscriptions will be terminated and the ability for clients to subscribe to this exchange as non-professionals will be removed. Professional subscriptions have been removed on Aug 1st 2018 as previously communicated here.

Subscriptions to be removed

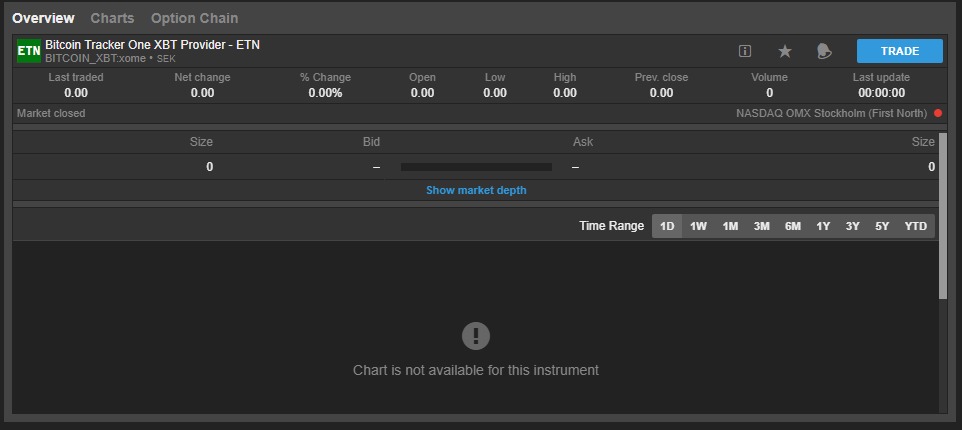

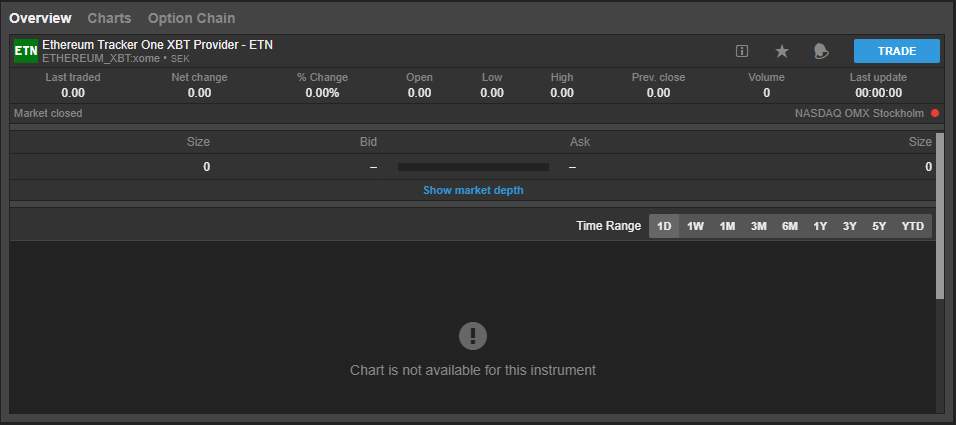

Current view of the instruments

Instruments on OMX that show zero on the price are supposed to be still tradable.

Please contact [email protected] if you have further questions about these changes.