GTS MobileTrader Enhancements

Over the coming months, improvements in design and functionlity will be coming to the mobile platform.

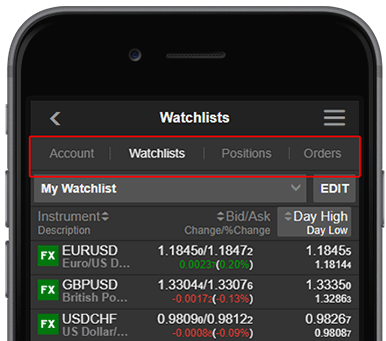

Navigation Improvements

Improvements to the navigation offering quick navigation between the most used sections of the platform:

- Watchlist

- Positions

- Order

- Account

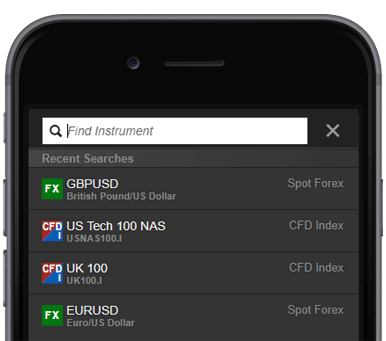

Search Enhancements

Search will deliver recently viewed instruments alongside a search input field for quick and easy access.

Market Data Changes (Reminder)

A number of exchanges will increase real-time data fees from 1 January, 2018.

| Stock Exchanges: | Private | Professional | ||||

|---|---|---|---|---|---|---|

| Level | Currency | Current Price | New Price | Current Price | New Price | |

| Euronext Stock Exchange | Level 1 | EUR | 1.00 | 1.25 | 63.00 | 68.00 |

| Level 2 | EUR | 1.00 | 1.50 | 91.00 | 95.00 | |

| Euronext Stock Indices | Level 1 | EUR | 1.00 | 1.25 | ||

| Futures Exchanges: | Private | Professional | ||||

| Euronext Commodities Derivatives | Level 2 | EUR | 12.00 | 15.00 | 12.00 | 15.00 |

| Euronext Equity & Index Derivatives | Level 1 | EUR | 1.00 | 1.25 | ||

| Level 2 | EUR | 32.00 | 34.00 | 32.00 | 34.00 | |

| OPRA Data | Level 1 | USD | 30.50 | 31.50 | ||

New Account Section Coming to GTS

The New Account Section recently introduced in the GTS-web platform will also be enabled in the desktop application. For more details, see here.