Product Updates & Enhancements

New product overview in GTS and GTS Pro

In April, we will be launching a major upgrade to the Product Overview pages in GTS and these pages will be made available in GTS Pro.

The overview pages will continue to offer an in-depth overview of the instrument selected in the watchlist, positions list, order list or through the global search function in the platform.

Summary

The Summary tab will continue to offer market overview for the instrument and can include:

- -market depth (for exchange traded instruments)

- -a simple range chart showing price movements for a selected period

- -Trade Signals (from Autochartist)

- -news

More sections with more information are planned in the near future.

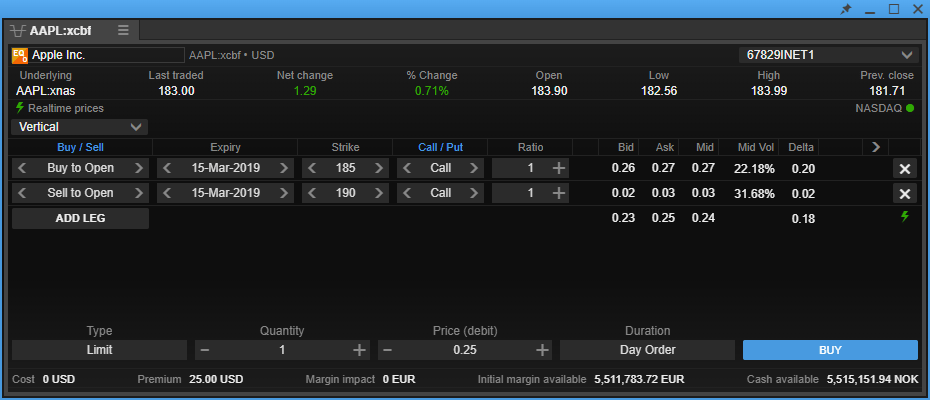

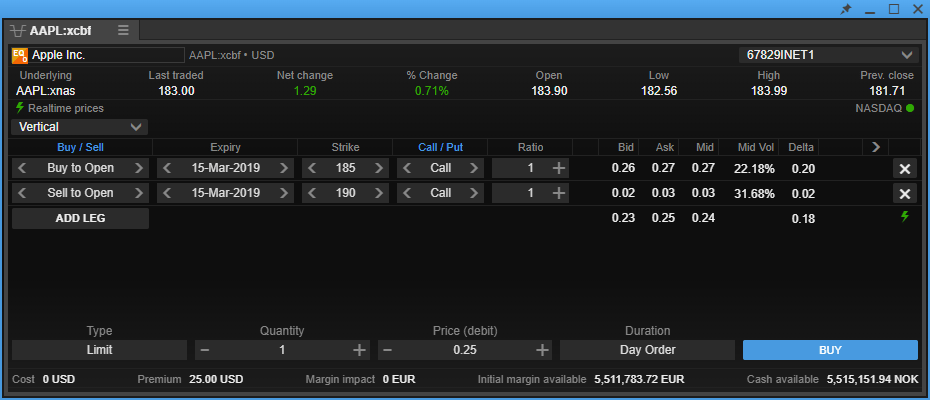

Combination orders for Exchange Traded Options in GTS and GTS Pro

In April, we will launch an Option Strategies trade ticket in the GTS desktop and GTS PRO platforms offering multi-leg exchange-traded option trades.

The new Option Strategies module:

- -offers a choice of common option strategies

- -supports custom strategies with up to 4 legs

- -will be launched from the option chain

- -will initially support US listed options

- -supports configurable columns for Greeks and market data

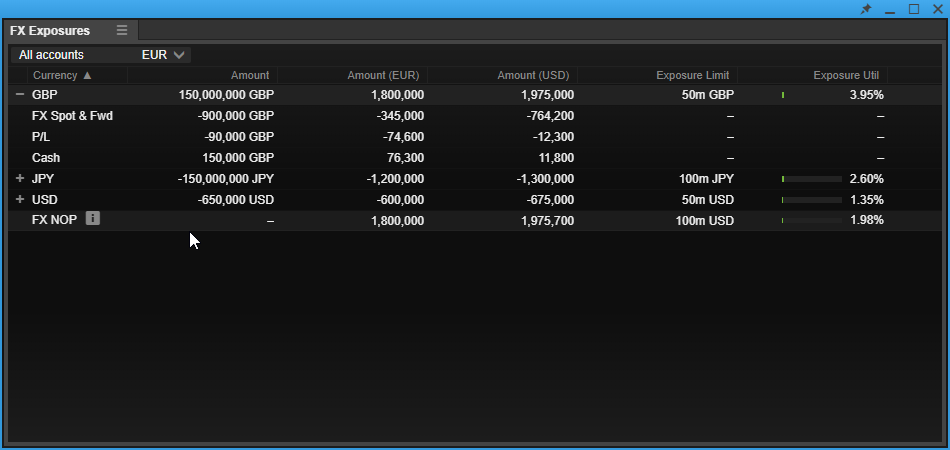

New Net FX Exposures module in GTS Pro – from April

In April, we will be launching a new FX Exposures module in TraderPRO which will give a detailed breakdown of your net FX exposures by currency.

The FX Exposures module will be available from the TraderPRO Menu as a module that you can dock in your workspace.

FX Exposures shows a breakdown of net position by currency for a selected account or group of accounts.

The columns show your net FX exposures:

- -by currency

- -in your account currency a

- -in USD

Customizable columns offer sorting by currency, exposure in account currency or exposure in USD. Exposures can be itemized by trade, P/L and cash components of the exposure.

The FX Exposure module also displays your exposure limit for each exposure currency the % utilization, and your total FX Net Open Position (NOP) exposure limits.

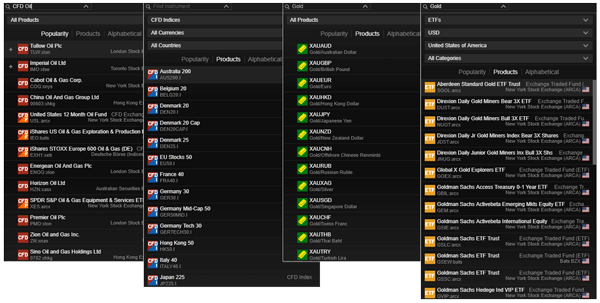

Advanced search – available from April

From April, an enhancement to the search will be available allowing you to refine searches by for example product, currency, country and sector and will allow you to sort results by product, popularity or alphabetically.

The down arrow on search fields will give access to the Advanced search options which allow you to filter results by:

- -Product (FX, FX Options, CFD indices, CFD Stocks etc.)

- -Currency (USD, EUR, GBP, etc.)

- -FX category (Majors, Minors, Exotics)

- -Country (for exchange listed products, Mutual Funds and Bonds)

- -Sector (for stocks, futures and CFDs)

- -Type (bonds, mutual funds, ETFs)

Results can further be sorted by:

- -Popularity (default option)

- -Product

- -Alphabetically

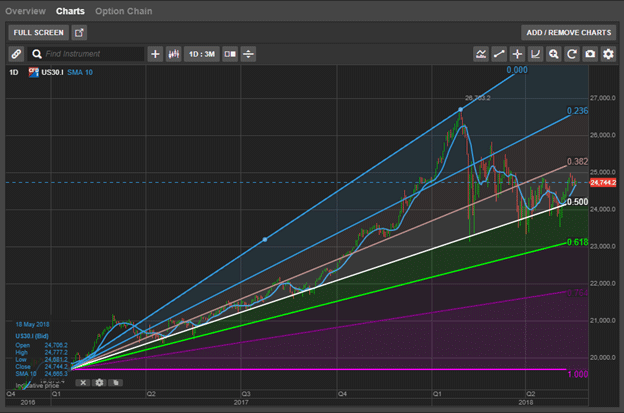

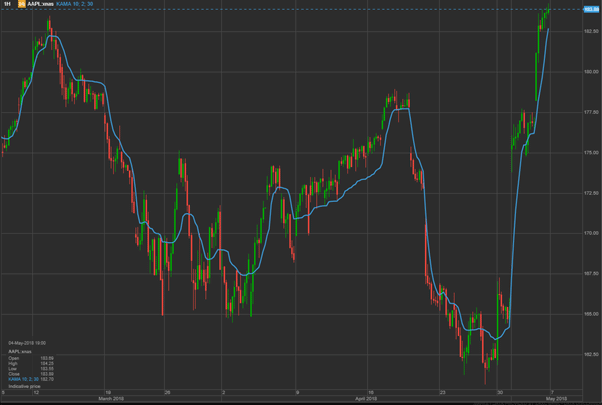

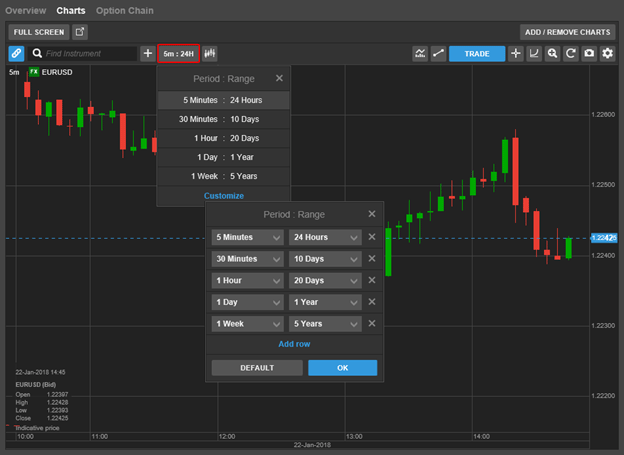

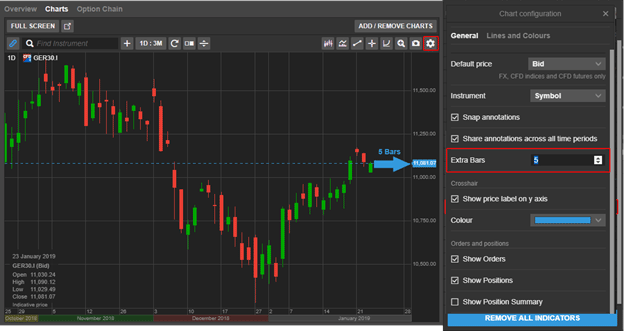

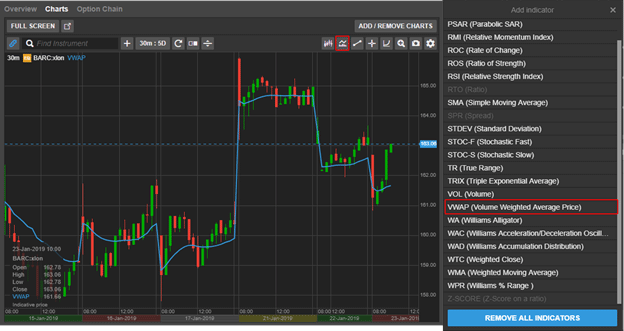

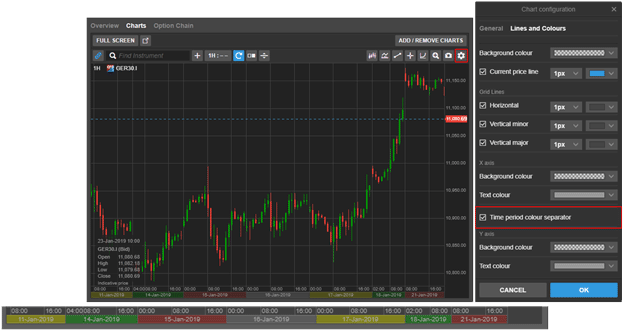

New chart feature

2- and 3-minute chart intervals are now available on charts in the TraderGO and TraderPRO platforms.

These can be added to the Period selector in charts by clicking the Customize link in the selector.

Operational Changes

Equity Research services discontinued

As previously announced, Equity Research will be discontinued in April 2019 and the Equity Research and Stock Screeners will be removed from all platforms.

Please contact [email protected] if you have further questions about these changes.

where you can edit:

where you can edit: