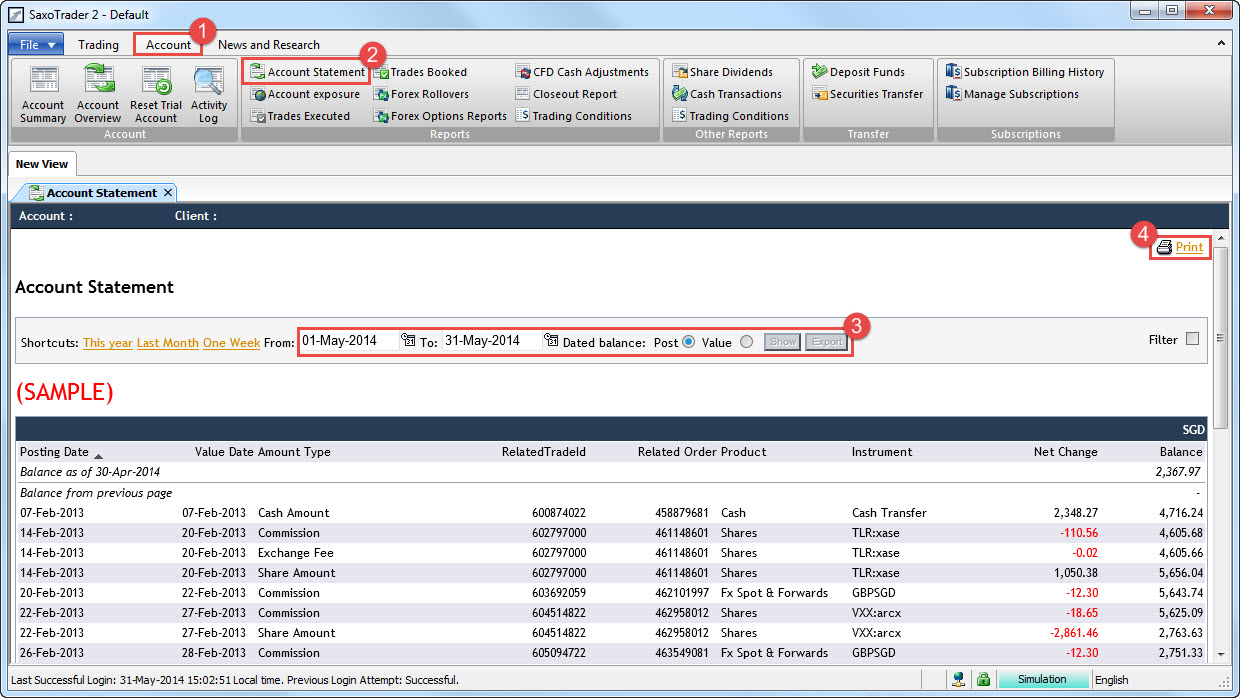

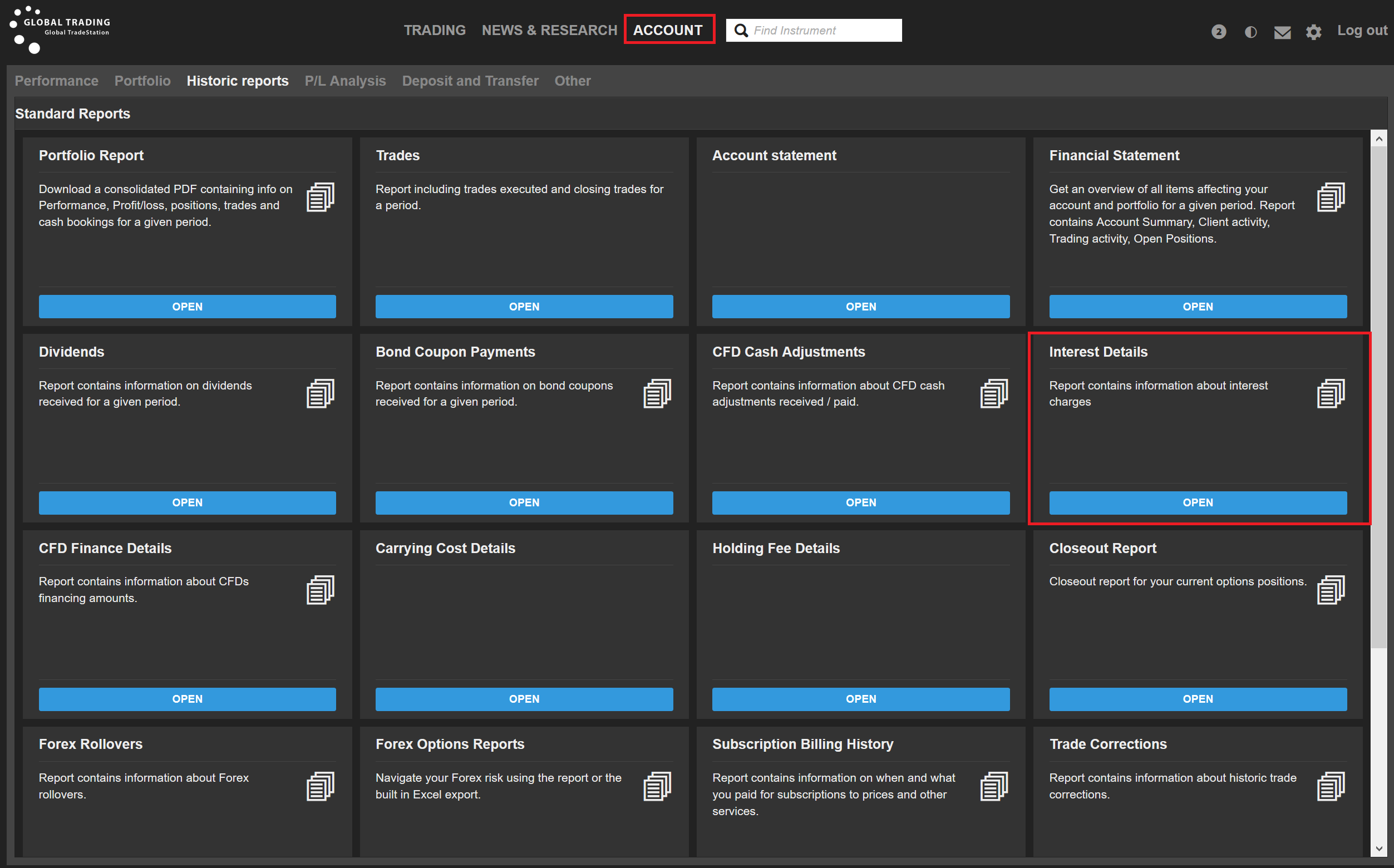

The Financial Statement gives an overview of your activity on an account in the selected period.

It consists of 5 main parts:

- *Client Activity: charges made to your account as a result of your trading activity, both for open and closed positions. This may include interest charges on negative account balances, share dividends and related withholding taxes. The section may also display cancellations of such entries.

- Activity in Margin Products: P/L, commissions and related entries pertaining to closed positions in margin products (for example: forex, CFDs, futures, FX Options, contract options)

- Trading Activity in Cash Products: P/L, commissions and related entries pertaining to closed positions in cash products (for example shares, ETFs and bonds)

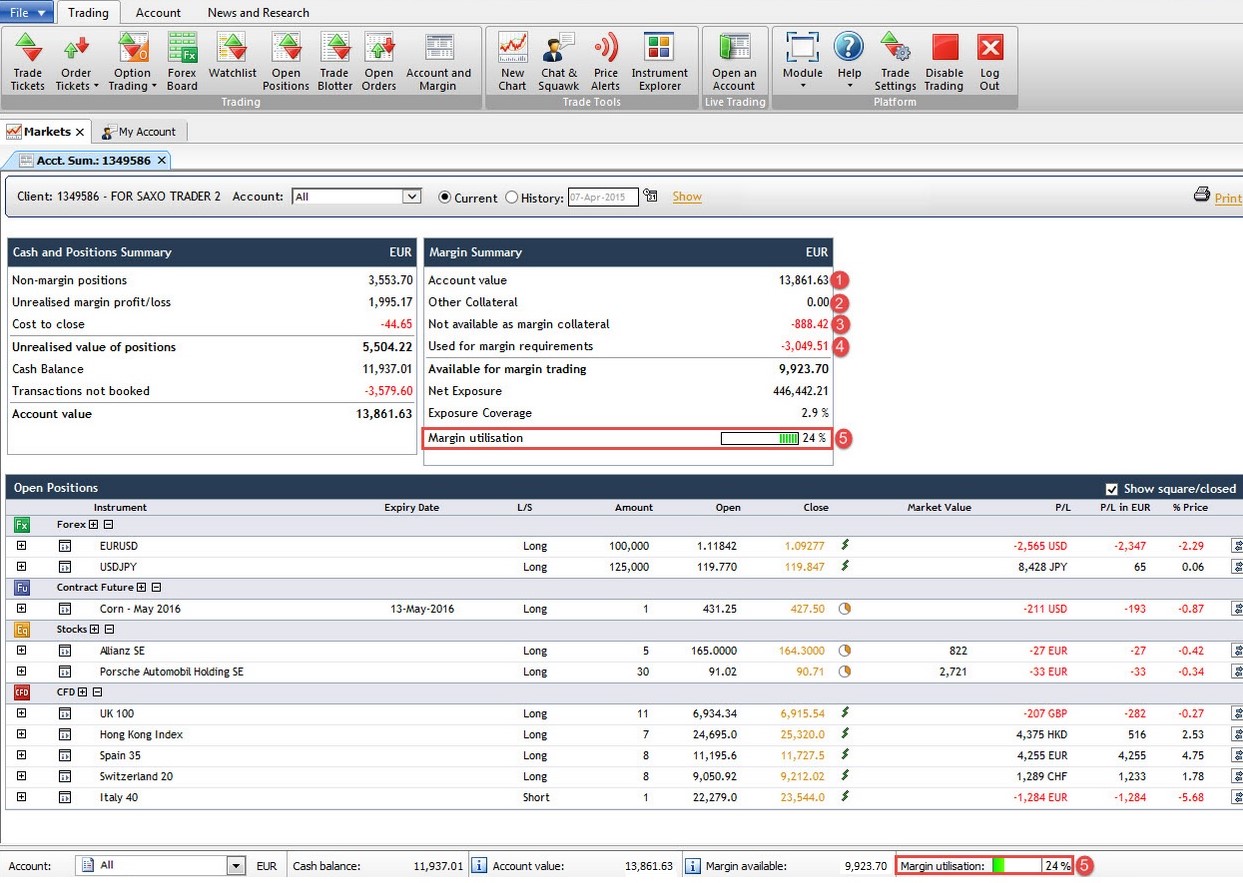

- Open Positions: shows positions in any instrument type open at the end of the selected period. For cash instruments, the value of the position is the market value. For margin instruments it is the unrealized P/L at the end of the selected period. ISIN codes are included where applicable.

Account Summary: shows a general overview of your opening and closing cash balances and total account values for the selected period.

*Regarding the Client Activity-section, the following definitions are often helpful:

- CFD Cash Adjustment: relevant for single stock CFDs and index tracking CFDs – when a stock pays out a dividend the share price falls also the price of the CFD will fall. To reflect that this fall is not a market move, when you are long of a CFD, you will receive a cash adjustment on the ex dividend date in the same amount as the dividend on the share, typically net of an “Adjustment Fee” designed to mirror the withholding tax. When you are short in a CFD, you will benefit from the fall of the CFD’s price, and again to reflect that this is not a market move, you will pay a “CFD Cash Adjustment” designed to reflect the full dividend. CFD Index Trackers will also be adjusted in the same way when the underlying shares pay out dividends.

- Return Adjustment: When a CFD Cash Adjustment is paid on a long CFD position (Also for index tracking CFDs) a Return Adjustment is subtracted, The Return Adjustment is designed to mirror the cash-flow from the default withholding tax rate in the relevant market for the underlying dividend payment.

- CFD Finance: CFD finance amount paid or received for some CFD types, for example most Index Tracker CFDs at Saxo are margined products, and you finance the traded value through an overnight credit/debit charge. If you open and close a CFD position within the same trading day, you are not subject to overnight financing. You can see the relevant financing rates in your trading conditions under “CFD Financing Conditions”.

- Borrowing Costs: amount paid or received on short single stock CFD positions. This is in addition to CFD Finance. If many market participants are interested in shorting a particular CFD, there will be an additional cost for shorting it because the cost of borrowing the share increases.

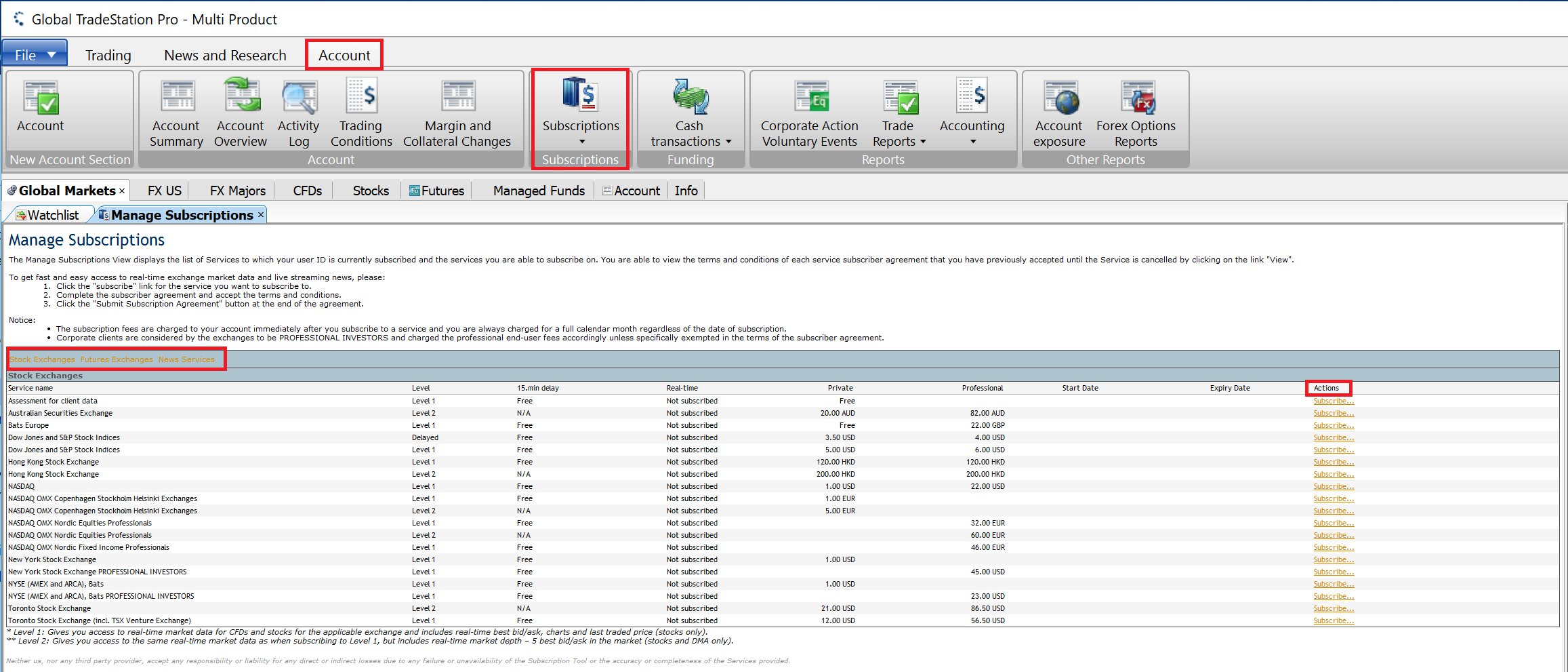

- Service Billing Amounts: Cost related to price feed / live data costs / news-feeds that you have subscribed to.

- Commission: Trading Commissions you have paid.

- Corporate Actions – Fee: Fee associated with a booking of corporate action

- Corporate Actions – Interest: Amount type for booking cash distribution for REITs

- Corporate Actions – Fractions: Fraction compensation received from a corporate action, for example in a dividend option or stock split.