Platform Updates

Real-time netting available from May

We are pleased to announce the release of real-time netting of positions in the positions list from May.

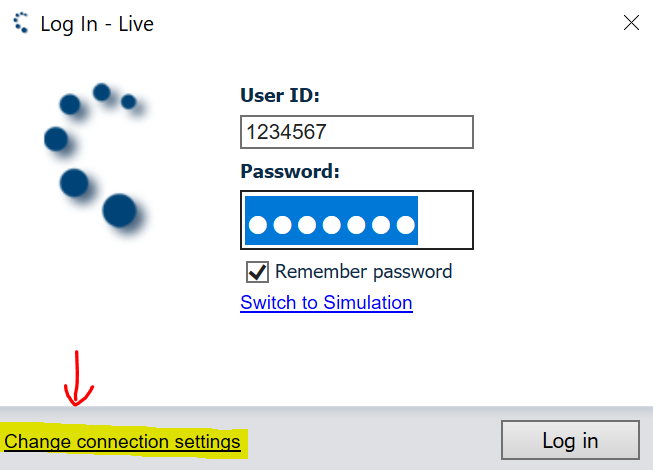

Real-time netting simplifies position management by dedicating your Positions list to open positions, moving closed and partially closed positions to a new Closed positions module until they are processed at the end of the day.

Real-time netting uses first in, first out (FIFO) netting where trades are closed in the order they were opened.

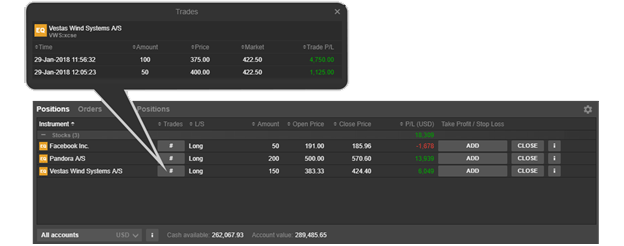

With real-time netting, you manage your net positions instead of individual trades. Individual trades can be seen in the new trades dialog.

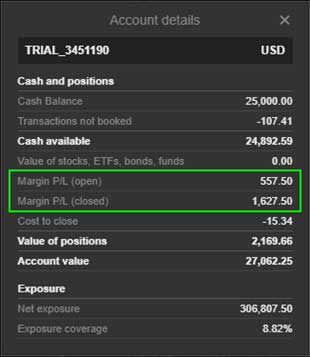

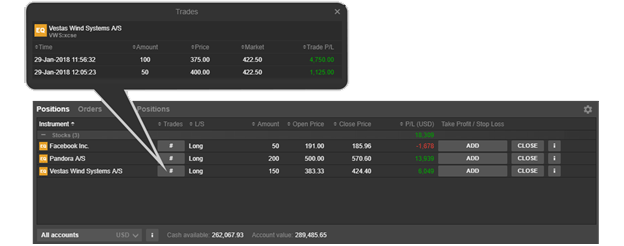

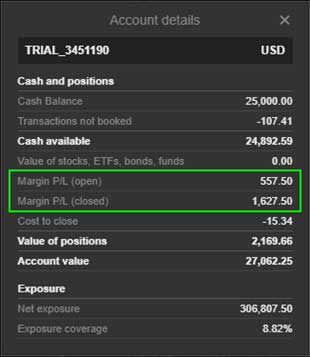

Open and closed margin P/L

With real-time netting enabled, margin P/L is split into its open and closed components.

Take profit and stop loss

Take profit and stop loss orders cannot be attached to individual trades. Independent take profit and stop loss orders can be placed instead and managed separately — if you close a position, you must also manually cancel any orders relating to the position.

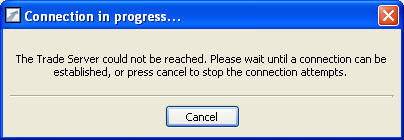

Enable real-time netting

Enable real-time netting on your account in the settings in all platforms. The feature can be enabled/disabled at any time.

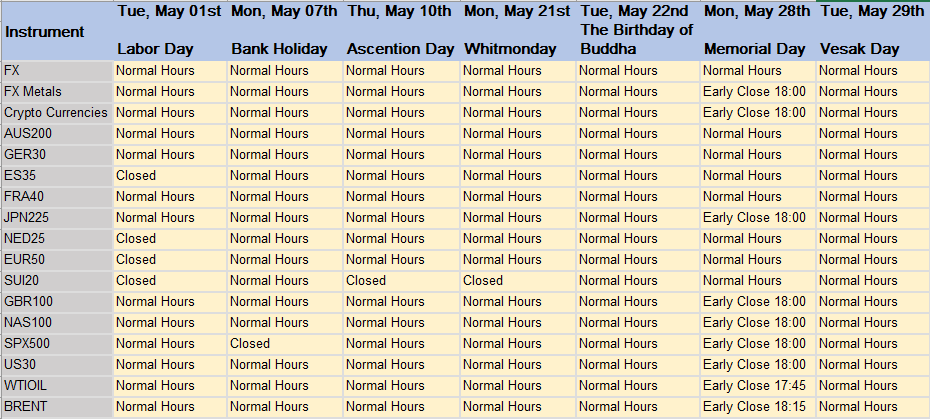

Works with all instruments

Real-time netting is supported by all instruments – margin and cash-traded.

Works in all platforms

Real-time netting works in all platforms – GTS and GTS Pro.

Update to GTS Mobile Platform

During the month of May, a number of updates will be coming to the GTS mobile platform. The updates will include:

-

Redesigned watchlist, orders and position pages

These pages have been redesigned in order to provide a simpler, cleaner layout, highlighting key data while providing quick access to more detailed information through the use of card navigation

-

Card navigation

The introduction of cards that display contextually relevant data and actions, will make navigation even easier for the user

-

Updated trade and order tickets

This design upgrade introduces a new, condensed ticket layout with more touch friendly navigation elements. This ticket upgrade will also be introduced on GTS for desktop and tablet in the near future

Discontinuation of stocks and options

Due to the heightened risk associated with options on rated 5 stocks and ETP (ETF, ETC and ETN) options that may themselves be leveraged, we have decided to discontinue support for selling rated 5 options on stocks and ETPs. The change will take effect on Tuesday, 15 May 2018. Clients with existing short positions will not be affected but will be unable to open new short positions.