Updated: June 27, 2019

Updated: June 27, 2019

Overview

In order to complete the migration of your Global TradeStation (GTS) brokerage account to Euro Pacific Trader (EPT), your new Interactive Brokers-powered platform1, you must “activate” your EPT account as soon as possible. Please follow the instructions below and refer to the Migration Timeline for future milestones.

Activation Instructions

1. Login to your eBanking

Read our recent secure message with the subject line IMPORTANT: Activate your new Euro Pacific Trader account now.

Haven’t received the secure message?

1. We are still sending out secure messages this week to our final set of GTS clients. You may email [email protected] to ask if your account is on our migration list.

2. We may also be trying to contact you to gather missing information or documentation on your account. Please check your recent secure messages for any unread mail.

2. Log into your EPT Client Portal

After logging into your EPT Client Portal for the first time, you will be asked to complete a short, electronic compliance form. This information will be used to process US Source Income every year, a mandatory regulatory requirement.

Note: Some clients may be required to fulfill outstanding document such as a W8 or CRS Form or may be requested additional documentation like a new, scanned proof of address, in order to keep our records up to date.

3. Check your account activation status

If you have logged into your Client Portal successfully and submitted your compliance form, your EPT account will be activated shortly, unless more information or documentation is required. To check your Account Activation Status, simply log into your Client Portal again.

If your account is activated, you will arrive at your Client Portal home page successfully.

If you have any questions about where you are in the activation process after you have submitted the compliance form, please create a case inside your eBanking Support Center and we will reply confirming the status of your Euro Pacific Trader account.

4. Trading enabled

As noted in the Migration Timeline, starting July 1st, all activated Euro Pacific Trader accounts will be:

- Enabled for live trading and enabled for funding.

Your new EPT account will be added to your eBanking “Transfer Between Own Accounts” function, so that you can fund it. Please note your brokerage account will be a new 10-digit account number.

- Credited with your GTS open equity positions completely or partially.

This will occur gradually over the period of July 1-19th.

Potential Trading Downtime

Please note that migrating your open equity positions from your GTS to EPT account may lead to a brief period of trading downtime on any transferred positions. As a result, after your GTS positions are removed, there may be a brief delay before they become visible in your EPT account.

Due to the complexity of the migration and the global nature of our offering, some positions may appear before others. Please be patient as we complete this process throughout the month of July.

5. Happy trading

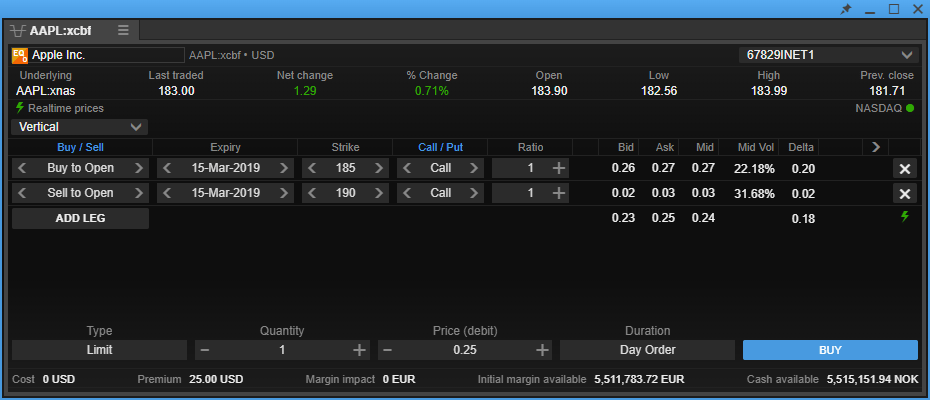

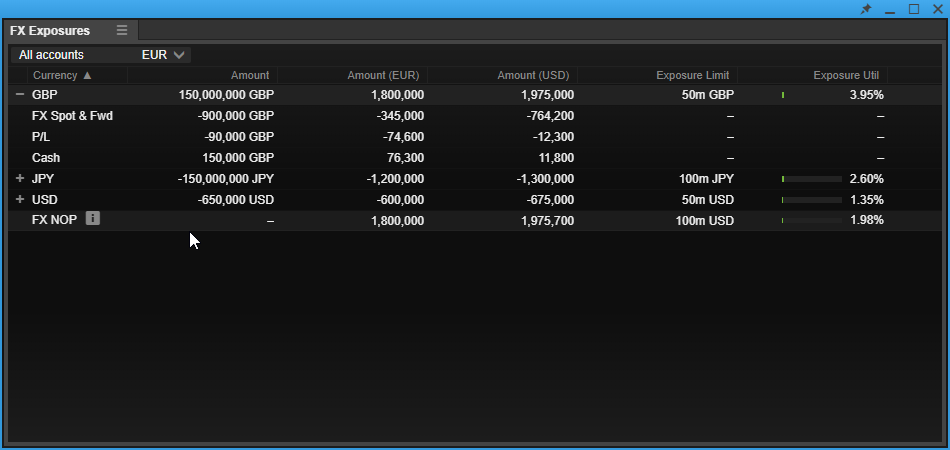

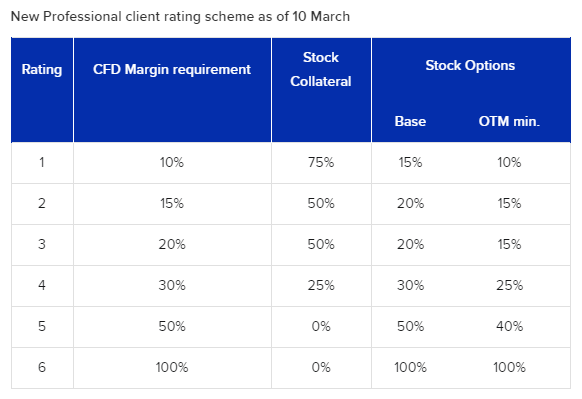

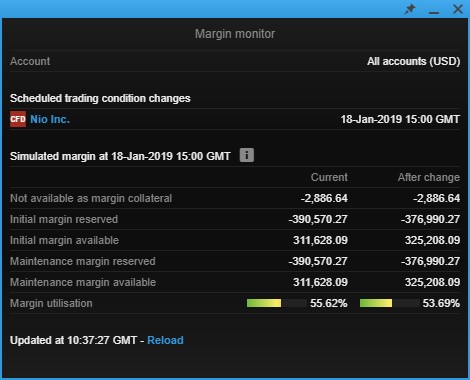

Initially, we will offer two platforms—the entry-level Client Portal and the flagship TraderPro. Click below to learn which is the most suitable for you.

Please note that the first time you log into your EPT account, you will be required to enable Two-Factor Authentication (2FA), per our security policies. You will be asked to go to a website and download the iOS and Android-based 2FA application.

Learn more →

6. View your account

To view your EPT cash balance and positions, please login directly to your Client Portal or TraderPro platforms. Due to the migration, your eBanking dashboard’s External Products section will not reflect an accurate balance at this time, but we do intend to re-launch this feature in the near future.

7. Re-enter any open orders

Unfortunately, open orders such as Stop Losses and Take-Profit (Limit) currently in your Global TradeStation (GTS) platform are tied to Saxo Bank and therefore cannot be migrated. If you have any open orders you’d like to maintain, please re-enter them in Euro Pacific Trader after your positions have been migrated there.

Concerned about your open equity positions?

Rest assured—all qualified migration clients’ open equity positions will be held by Euro Pacific Securities until the corresponding client has completed the instructions below and your open equity positions will not be forced liquidated. If you have received an eBanking secure message with your new Euro Pacific Trader login details, you qualify for the brokerage migration.

Note: Not all open equity positions can be migrated. There is a shortlist of equities that are not supported by our new custodian. Affected clients will be notified accordingly when this list is finalized.

1Disclaimers:

Euro Pacific Trader is offered by Euro Pacific Securities Inc. (“Euro Pacific Securities”), as an Introducing Broker to Interactive Brokers LLC. Interactive Brokers LLC is the custodian, technology provider, and clearing broker to all transactions executed through Euro Pacific Trader and thus the rates, conditions, and examples shown on this site may be subject to change and differ from what is displayed on Euro Pacific Trader. The rates, conditions, and examples on this site are provided on a best-efforts basis and should not be taken as final.

Euro Pacific Securities will not be held responsible for pricing and conditional discrepancies that may arise in the normal course of offering Euro Pacific Trader. Customers should always review and rely on the conditions that are shown directly on Euro Pacific Trader, and it is the responsibility of all customers to carefully review the conditions of every action before approving execution on Euro Pacific Trader.

Interactive Brokers LLC is a registered Broker-Dealer, Futures Commission Merchant and Forex Dealer Member, regulated by the U.S. Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA), and is a member of the Financial Industry Regulatory Authority (FINRA) and several other self-regulatory organizations. Interactive Brokers LLC does not endorse or recommend any introducing brokers, third-party financial advisors or hedge funds, including Euro Pacific Securities. Interactive Brokers LLC provides execution and clearing services to customers. None of the information contained herein constitutes a recommendation, offer, or solicitation of an offer by Interactive Brokers LLC to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Interactive Brokers LLC makes no representation, and assumes no liability to the accuracy or completeness of the information provided on this website.For more information regarding Interactive Brokers, please visit www.interactivebrokers.com.