Published: January 9, 2021

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold & Precious Metals

- Peter Schiff

Our Commentary

A look back at 2020

Describing 2020 as a roller coaster ride for investors does not do justice to the unprecedented series of events ushered in by the pandemic and the lockdowns across the world.

Although many markets sold off steeply into bear market territory as the pandemic escalated in March, the US Dow Industrial Average still managed to deliver 7% growth for the year after breaking through 30,000 for the first time in November. European indices including the UK FTSE 100 and equity markets elsewhere ended the year significantly lower.

As with equities, fixed income assets like sovereign debt sold off sharply in March but recovered quickly as announcements of central bank intervention soothed worst fears.

Stock market gains, however, bore little relation to the economic havoc wrought by the virus. Most countries experienced severe economic losses in the second quarter of the year before bouncing back in the third quarter when lockdowns were lifted.

The world economy ended the year on an uncertain note, with the impact of second and, in some instances, third waves of infections still to be quantified across developed and most-affected emerging market countries.

China stood out as the country that most quickly brought the virus under control and became the first economy to find its feet again. As such, it is expected to be the only country that will achieve positive growth in 2020.

Geopolitical uncertainty will prevail in 2021

It hasn’t just been the health and economic crises that made the financial market outlook so challenging to anticipate.

The US elections and Brexit negotiations have also dominated sentiment, and as we head into the new year, the fallout from these geopolitical events continues to hold sway.

US President Donald Trump made controversial presidential pardons and continues to challenge the Electoral College results.

In the UK, which continues to suffer severe economic hardship as a result of the pandemic, the last-minute Brexit agreement has at least averted the worst scenarios of short-term economic disruption.

China-US trade tensions also continued to hang over global geopolitical relations. However, while still likely to take a hard stance against China, a Biden presidency is expected to see the relationship between the two countries become less confrontational and volatile.

Vaccines give cause for hope

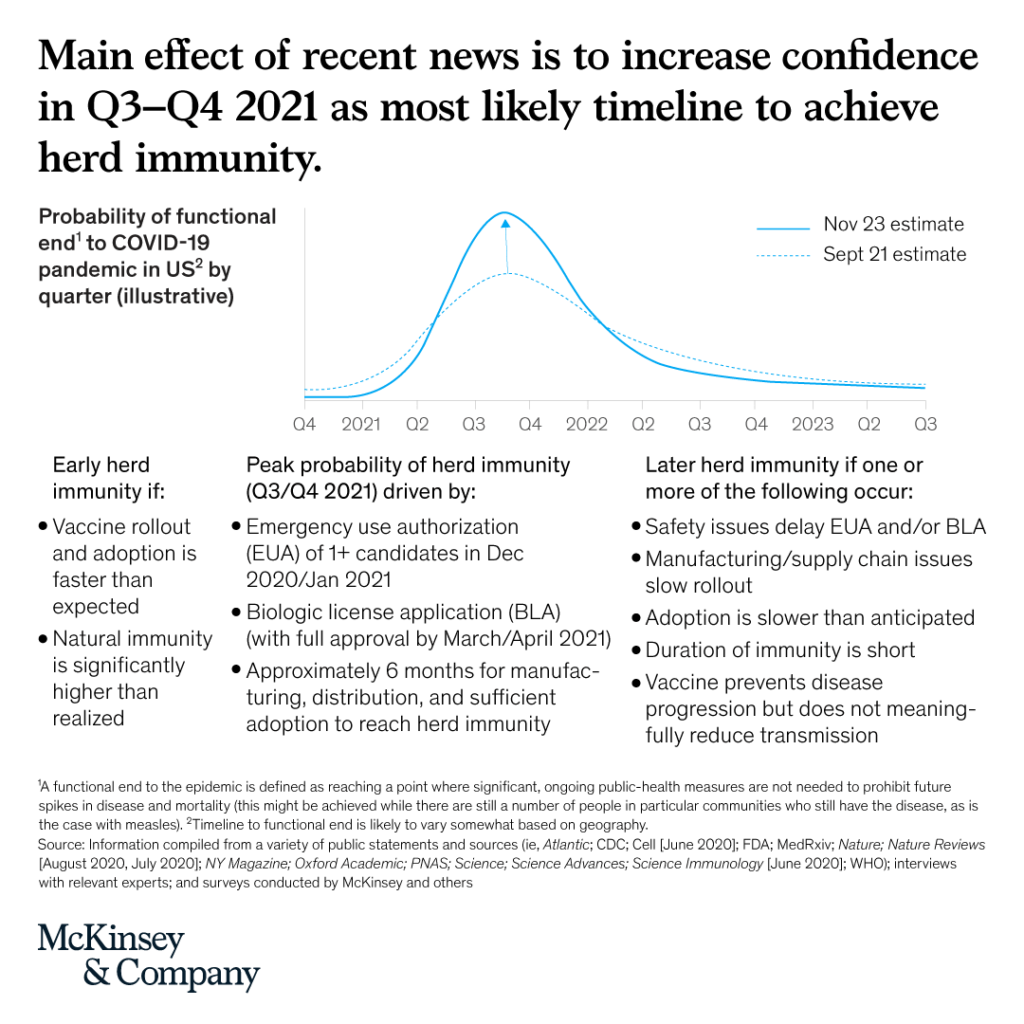

Looking ahead, much will depend on the successful rollout of the vaccines that have been given emergency authorisation. The prevailing hope is that the bulk of the populations in the developed world may be vaccinated by the middle of the year. Consultancy McKinsey believes the positive news about the vaccines in November makes it possible that herd immunity could be achieved by as early as the second half of 2021 and captures its thinking in the graph below.

But there are significant risks to this outlook. In addition to logistical obstacles, surveys like McKinsey’s (below) indicate up to half the US population will or may be unwilling to be vaccinated. Without a significant uptake, herd immunity will not be possible and the health impact of the pandemic is likely to be longer-lasting than currently factored into many of the economic forecasts for next year.

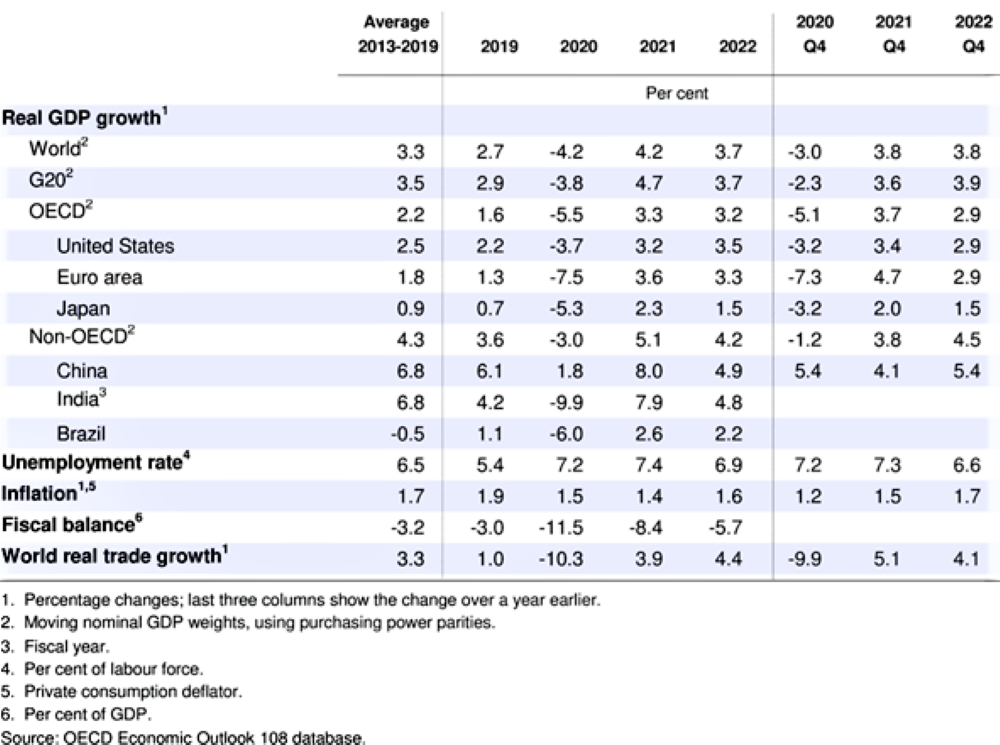

On the positive side, the Organisation for Economic Co-operation and Development (OECD) is expecting a brighter economic outlook for 2021 but cautions that the recovery will be gradual in its December World Economic Outlook. The organization sees vaccination campaigns, concerted health policies and government financial support as likely to result in global growth of 4.2% in 2021 after an equivalent fall of 4.2% in 2020.

The expected bounce-back is forecasted to be most robust in Asian countries where the virus appears to have been brought under control quickest. Elsewhere, even by the end of 2021, many economies will not be back to 2019 levels, according to OECD’s latest projections:

Meanwhile, Oxford Economics sees a mid-year boom following a “meaningful and sustained” lifting of restrictions in March or April and has raised its 2021 forecast for global growth to 5.2% from 4.9% based on a faster vaccination rollout than previously assumed. It estimates a 4.0% decline for 2020.

The investment case for emerging markets during 2021 is promising, particularly in Asian emerging economies that have managed to get the virus under control earlier than their emerging counterparts. Although vaccine rollout may be slower, more substantial demand from advanced economies, rising commodity prices and the ongoing weakening of the US dollar should all prove supportive for emerging markets.

India stands out as a country that has managed to turn around its economic fortunes, an achievement recognised by sovereign credit rating agencies which have upgraded their 2020/2021 fiscal year growth forecasts for the world’s second-largest emerging market. S&P Global Ratings now expects the contraction in India’s economy during the year to March 2021 to be 7.7% compared with its previous 9% forecast decline.

Our Equity Outlook

Barring a significant deterioration in the outlook for overcoming the pandemic, the investment outlook for risk and cyclical assets looks reasonably promising. Economies look likely to gather momentum again. Investors will seek growth potential in an environment where monetary and fiscal policy stimulus is likely to remain in place for the next few years and interest rates are likely to stay near zero.

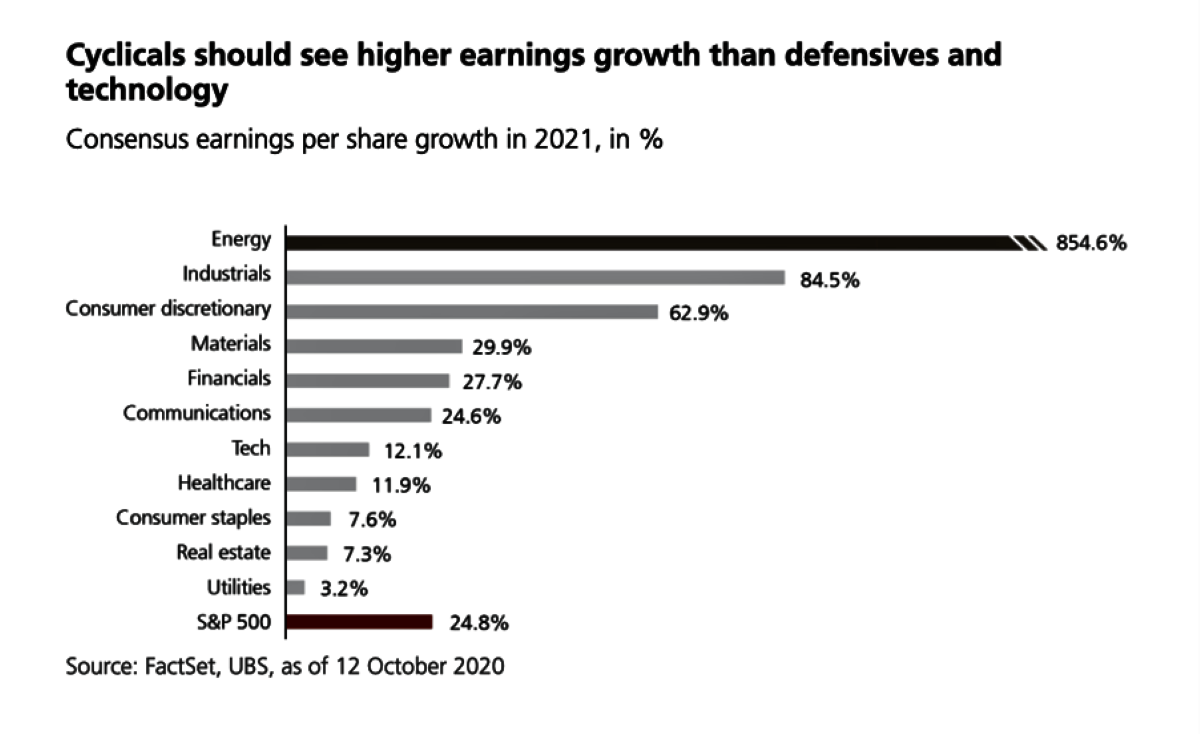

UBS expects fiscal stimulus and the rollout of a vaccine to drive the economic recovery and outperformance in earnings for mid-cap stocks and select cyclical sectors, relative to large-caps.

While the Big 5 tech stocks are largely seen to have run their course, Asian tech stocks offer attractive potential. Notwithstanding anti-trust scrutiny, the technology sector will see strong secular growth in digital advertising, e-commerce, cloud computing and the 5G rollout.

The Inflation Question

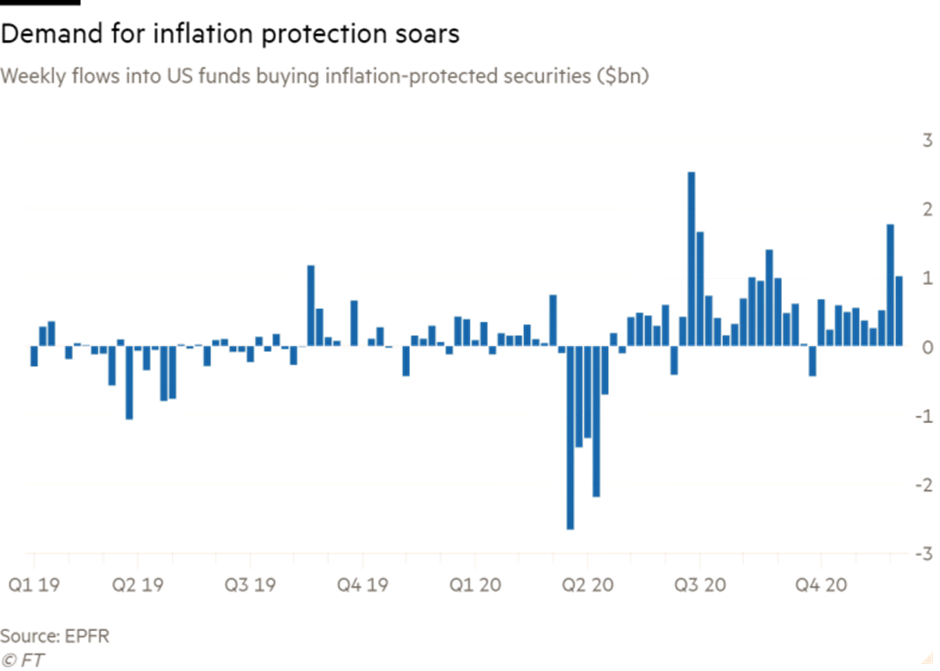

The one much-debated unknown—whether inflation could take hold during 2021 against a backdrop of easy money—is the one risk that needs to be monitored carefully during the year. Opinion is still divided on how much of a risk potential inflation represents.

The concern is that if inflation does reappear, it would be challenging to eliminate given the multi-trillion-dollar stimulus programs needing to be unwound. Nevertheless, investors are increasingly seeking inflation protection instruments, as shown in the graph below.

Ethical investing comes to the fore

We have been reporting about the rise of funds that prioritise environmental, social and governance (ESG) considerations in their mandates since November of this year.

One promising outcome of the 2020 Covid-19 crisis has been the increased awareness and understanding of how material the health, social or environmental risks can be when faced with a crisis of such epic proportions. This awareness translated into a profound shift in investor appetite with flows into these ESG funds picking up materially during 2020 and expected to continue during the years ahead.

There’s no doubt that the consequences of 2020’s devastating confluence of health, economic and geopolitical events will be felt for years to come. We are, however, cautiously optimistic about the global economic outlook given the light at the end of the tunnel that the vaccines provide.

Portfolio Actions

As all previous financial market crises have shown, investment opportunities do arise during times of uncertainty and volatility. Those investors who can identify these through robust, fundamental analysis, and who are prepared to wait for the growth potential to be unlocked, stand to benefit most.

We continue to seek such opportunities to add to the growth potential for your portfolio. The portfolios’ composition remains unchanged as we stay cautious while awaiting new economic data before opening new positions.

Regards

Euro Pacific Advisors Management Team