Global Trading have partnered with GlobeTax to offer a variety of tax reclamation and relief at source services.

The following services are available to clients:

- Tax Reclamation service for non-US sourced income

- Tax Reclamation service for US sourced income

- Relief at source to reduce tax withholdings on an ongoing basis

Steps to access the different services are outlined below. Please be aware that Euro Pacific Bank and Global Trading receive no compensation for the use of these services. The relationship with GlobeTax has been established solely for client convenience.

IMPORTANT NOTE: Please quote your Saxo ID number when registering.

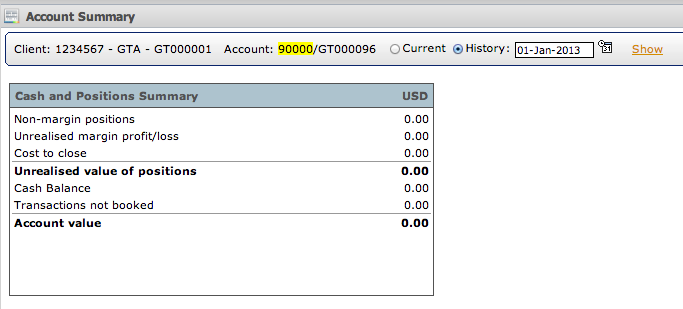

The ID is a numeric code that can be found through your online brokerage account in the “Account Summary” tab. Please click here for a sample (highlighted). Do not quote your GT number as GlobeTax will not be able to read this.

Tax Reclamation Service — Non-US Sourced Income

eDocs Access

- Navigate to https://edocs.globetax.com/secure/logincreateuser.aspx?institution=globaltrading

- Register with access code 12C953BGLT

- Once your account has been created online and GlobeTax have received your signed documents, your income data file will be requested and analyzed for any valid reclaims. Any identified reclaims will then be filed on your behalf.

The minimum reclaim amount is US$100. Please note that repayment time frames will vary market to market and can range anything from 6 months to 5 years.

eDocs supports reclaims to all markets where there is a process, with the exception of the US (see below).

Tax Reclaim Service — US Sourced Income

Tax Reclaim Services for US Sourced Income are no longer being offered by GlobeTax due to the increasing complexity and cost involved in the long form reclaim process. All investors earning US Sourced Income are encouraged to look at the Relief at Source solution presented below to prevent further withholding.

Relief at Source Service – US Sourced Income

Global Trading have partnered with GlobeTax to provide a Relief at Source service meaning you will be taxed at source, at the correct treaty rate, rather than the full withholding rate of 30%. In order to take advantage of this service please follow the instructions below to register on the eCerts portal which will create a W-8 Form for submission to GlobeTax. Once the form has been validated you will begin to get Relief at Source.

eCerts Access

- Navigate to https://edocs.globetax.com/ecerts/

- Register with access code USDOCS57

- Enter your Client ID and follow the on screen instructions.

The fee for this service is $35 (for a 3 year period) payable online before you can print the document. GlobeTax can only accept W-8 forms produced electronically via the portal.